Businesses and organizations usually use receipts as part of their business processes. But what if you’re someone who just sold a preloved appliance or furniture in cash? Firstly, you must understand what a cash receipt is in order to easily create one and make the purchase official.

For those planning to open a startup business, it’s also vital to understand what are cash receipts in accounting. Even contractors, freelancers, and individuals who often sell goods must learn how to handle cash receipts effectively. Doing so makes a significant difference in terms of financial management, tax compliance, and record keeping. Properly managing cash receipts ensures accurate financial tracking, helps monitor cash flow, and supports better decision-making for future business growth and sustainability.

What is a Cash Receipt?

A cash receipt is a document and part of a company's or individual's accounting entry. It records the collection of cash from customers. Besides serving as proof of payment, cash receipts increase the business's cash balance and simultaneously decrease accounts receivables or asset accounts.

Definition and Purpose

In its simplest form, a cash receipt is a printed or written record issued by sellers to buyers as proof of purchase. They can be paper receipts, emails, or digital receipts. Regardless of its form, the purpose remains the same - it’s to document the seller’s transactions.

Moreover, the receipt records the transaction between both parties, eventually reducing the possibility of disputes. Most importantly, the document is an official record companies can use for tax and audit purposes.

Some important details that must be included in your cash receipt include the amount, transaction date, name of the payor and recipient, a brief description of goods or services availed, and relevant invoice details and reference numbers.

Common Scenarios

Understanding what a cash receipt is also involves knowing where most people use such documents.

- Small businesses issue cash receipt after accepting payment for purchased products.

- Freelancers and contractors can also provide cash receipts after receiving payments for rendered services.

- Cash receipts can be used for personal sales. Some buyers might need a document as proof of purchase.

- Rent payments usually involve cash receipts to prove that the renter’s due is settled.

How to Write a Receipt for Cash?

There are several styles and ways to write a receipt for cash. While creating your own cash receipt is easy, the process needs attention to essential details to ensure accuracy. Refer to the following guide.

Step 1. Provide details for the header. Regardless of where you’ll use the receipt, it must look concise and professional. Include your name and company (if applicable) to identify the source of the cash receipt. As previously mentioned, you must also specify when the receipt is issued. Remember also to include the receipt number for easy recording and tracking. Most large businesses already have official receipts with corresponding numbers. However, small-scale sellers might issue cash receipts manually.

Step 2. Transaction information. When writing the amount received from sellers, input the accurate number, including the centavos (if available). After all, cash receipts may serve as official records. Along with the amount paid is the name of the payor. To complete the transaction details section, write a small description of the product or service involved.

Step 3. Additional details. This is a space in the cash receipt where you can specify the payment method. Input that the product or service is paid through cash. Other notes about the transaction, like whether it's a full or partial payment, can be indicated in this section.

Step 4. Signature. You must remember to sign every cash receipt, making the document authentic and official. It’s also recommended that you place your name before signing it.

Step 5. Contact details. Include your phone number, company or residential address, and email in case the payor has any follow-up concerns.

Sample Template

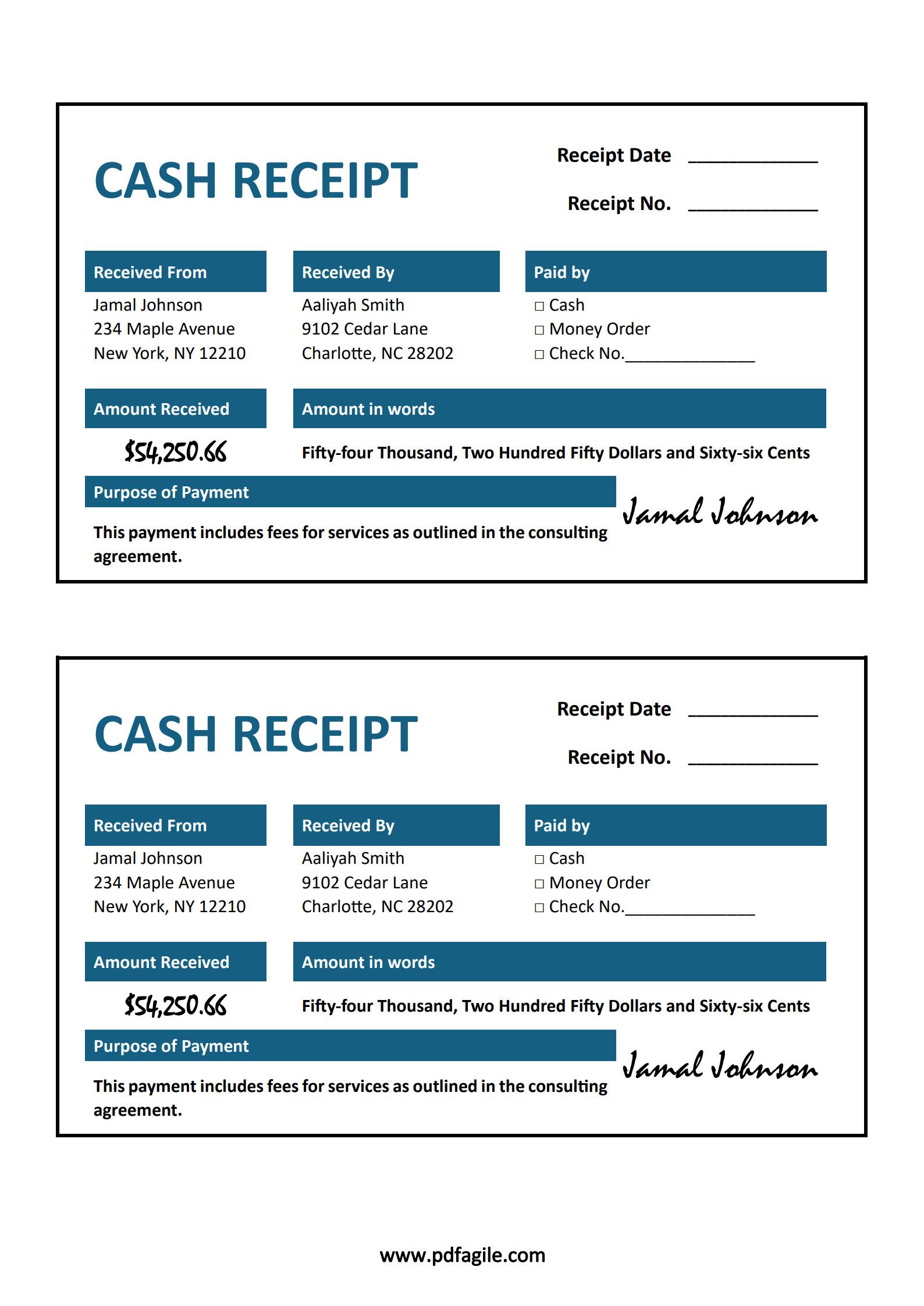

You can refer to the sample cash receipt below. Remember that you can always tweak some of the details and placement below to make it your own.

[Receipt Number]

[Seller’s Name or Company Name] [Date]

[Payor’s Name]

[Amount]

[In words]

[Description of goods and services]

[Payment method] [Additional notes]

[Printed Name of the seller] [Signature]

[Contact details]

[Phone]

[Email]

Tips for Writing a Cash Receipt

Making a cash receipt can be intimidating for new business owners or individuals selling goods for the first time. The template above shows several things you must include to look professional and represent the business or yourself accordingly.

Here are a few tips and best practices you may consider as you write cash receipts.

- Customize your cash receipt template. We previously mentioned how you can change the placements, style, and sections on your receipt. For businesses, customization ensures the receipt reflects the brand or company. As you make your logo and company on cash receipts, you’re also promoting the business for every transaction.

- Be clear and concise. In most cases, cash receipts are written on small papers. Therefore, you must construct words that are easy to understand to accommodate all types of payors. Avoid writing longer words. The last thing you want is to confuse your clients with vague details.

- Maintain digital and physical copies. This process can be taxing if you have to deal with hundreds of cash receipts. However, keeping the physical receipts and encoding them in your digital database makes it easier to track transactions. Most importantly, backing up the receipts ensures you still have records in case the original is damaged or lost.

- Review the details. Before you sign and issue the receipt, you must confirm that all information is accurate. Since it's a numbered document, you can't easily replace it if you entered the wrong details or misspelled words.

Besides ensuring you compose a concise cash receipt, performing regular cross-checks on issued receipts is also helpful. Doing this weekly lets you or your business identify possible discrepancies in your records.

What Are Cash Receipts in Accounting?

Like how creating cash receipts requires attention to detail, accounting and recording these documents must also be done meticulously. Accounting can be an overwhelming word, especially for those outside the industry. However, it’s simply about keeping tabs on cash receipts and ensuring they are accurate. Doing so ensures that all the company’s cash inflows are duly accounted for and can be tracked back.

Cash receipts can generally be visible on the cash flow statement, which provides a broader overview of your business finances. It shows how cash moves in and out of the business, providing a clearer picture of the company’s liquidity and ability to achieve short-term obligations. You can also find cash receipt records in your balance sheet. Essentially, they automatically increase the cash amount of a business as a part of the assets.

How to Manage and Keep Track of Cash Receipts?

First, receipts must exist so the accountant can record them. Most refer to this as making a cash sale. Remember to keep all the cash receipts, as they're proof that the sale happened.

Next, record the receipt transaction. You can do this manually using a ledger or input the details of the receipt digitally. Regardless of your preference, cash receipts must be recorded chronologically. This makes it easier to find specific records in the future.

Finally, input the receipts as a debit in your cash receipts journal. Remember that the entries vary if your business offers credits or if the buyer used a combination of payment methods.

Best Practices for Handling and Storing Cash Receipts

Businesses and accountants generally have different processes for handling cash receipts. Some of them include the following.

- Record the receipts as they’re issued. Some log their receipts weekly, but doing so can be a handful, especially if you have to deal with hundreds of cash receipts daily. If you have time in the day to record the receipts, that’s much better. Data entry can also be in an electronic or manual format.

- Reconcile the cash receipts. Cash registers must be balanced daily. Ensure that short/over amounts are monitored. Whether it’s a small or large business, there must be a dated and signed reconciliation document.

- Keep the physical cash receipts confidential. The document is an integral part of the company’s cash flow. Only authorized individuals can access the cash receipt records, whether they’re the originals or digital copies.

- Seek an accountant’s professional advice. Those in the accounting field know how to effectively manage cash receipts and other vital files associated with a business’s financial matters.

For Further Reading

Creating cash receipts is straightforward, as seen in the example above. Tracking cash sales transactions and payments is core to a company’s success. Cash receipts are often overlooked, but they are vital in ensuring your books are accurate, the taxes are in order, and the business cash flow stays strong.

As you learn and explore the intricacies of cash receipts, PDF Agile makes it easier to formulate your cash receipt structure. The platform offers editable templates, and PDF Agile offers extensive customization options on these templates, ensuring you get the design and layout you want for your receipts.