Introduction

Suppose you ask whether you need a will or not; the short answer is yes. Essentially, if you fail to make your wishes and decisions legally binding using a Will, the state will decide to divide your property. Additionally, if the property owner has a spouse or legal partner but has no children, they will assume ownership of all your properties. It can also become confusing when the owner does not have any children or legal partners. In most cases, all you own can go to the state’s property.

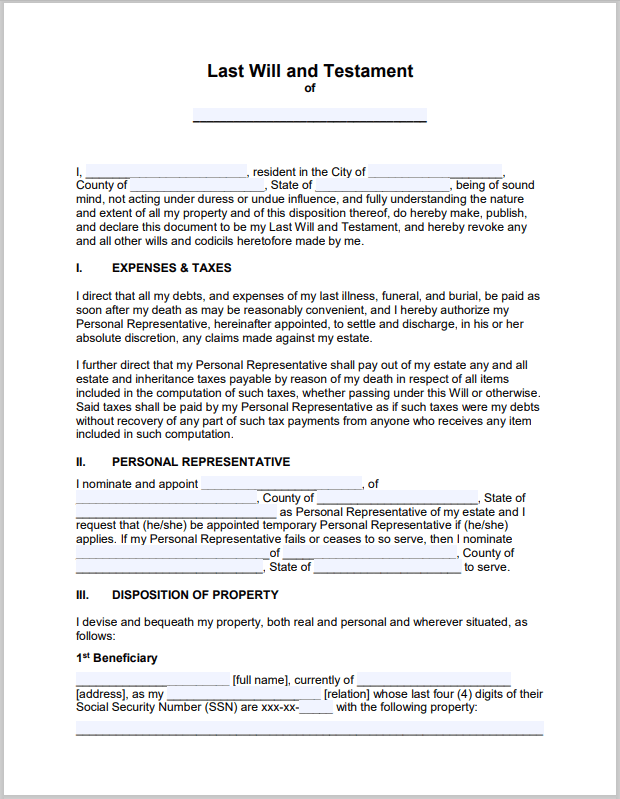

It will be ideal for someone who owns valuable properties to write and leave a will. This article will give you an overview of a Last Will and Testament template, its benefits, and how to create one effectively.

Last Will and Testament defined

Last Will and Testaments are legal documents setting forth the owner’s preferences on the distribution of assets after death. Inside the paper are details about who inherits the owner’s money, personal belongings, and other real estates like a home. The person formulating the Will is called the “testator.” Meanwhile, the organization or individual tasked to oversee the estate after the testator’s death is the “executor.” Additionally, a testator can also leave contributions to charity and bequests by including them in the Will. The Last Will and Testament can also describe how the funeral must be conducted and possibly provide money.

One can determine the asset value by listing first the assets and possessions like a home, vehicles, insurance policies, bank accounts, investments, stocks, bonds, etc. After listing, the testator can deduct the liabilities and debts from the listed assets and determine the actual value of the estate. Liability can be a student or personal loan, mortgages, overdrafts, credit cards, etc.

The purpose of the Last Will and Testament

Before getting a Will template, it might also be necessary to know its purpose, as this is not only about ensuring the property is divided accordingly after death. There are far more reasons why one needs a Last Will and Testament.

- Ensure appropriate distribution of assets. When you die without a Will, the law will decide how your assets will be distributed. In some cases, some of the properties might be automatically handed over to children or a spouse. Additionally, the actual distribution will depend on the property value and the terms of the title deeds. The Last Will and Testament is the only way to carry out all the testator’s wishes.

- Outline and appoint the powers of a trustee or an executor. Creating a Will allows the testator to decide who will supervise and oversee the distribution of the estate. Entrusting the Will to an impartial and trustworthy Executor ensures the testator peace of mind that all the terms of the Will will be realized.

- Appoint guardian/s for minors. The Last Will and Testament will also perform as a legal document guide for the welfare of children in case the death of both parents happens.

- Specify funeral requests and wishes. To avoid stress for loved ones, a Will ensures that your body will be treated as you want it. Additionally, you can choose whether you prefer burial or cremation.

- Expedite legal processes. Since the Last Will and Testament template will provide all the testator’s preferences on where the properties should go, it will lessen cost and expedite the process. Reducing legal fees also protects the property value and savings meant to be passed to beneficiaries.

- Reduce stress for the loved ones left behind. As you may know, property distribution can be tricky. Furthermore, it can result in arguments among beneficiaries. However, a Will at hand reduces family disagreements and confusion, especially during emotionally challenging times.

Steps in writing a Last Will and Testament

A Last and Will Testament sample will show you what the documents should look like. Every will creator will vary in how they formulate the document. Here are some essential steps you can refer to while making your own.

- Add the personal information. At the document’s header, input your name (testator). Also, include your address and information about your children and spouse.

- Add the details of the executor. The executor has to carry out the term of the Will. There might be some restrictions as to who can be legally an executor. Furthermore, it will depend on the state you are in. It is worth noting that all states only allow individuals at least 18 years as an executor. Also, it might be beneficial to assign a successor executor if the primary executor fails to fulfill the responsibility.

- Include executor powers and compensation. The Will should also state whether you want to provide compensation for the executor or have specific powers. In this part, ensure to be as detailed as possible on the executor’s compensation, or you can also have it at their discretion.

- Specify the beneficiaries. Be it cash, remaining estate, or personal property; the testator must include the beneficiary’s name and the specific assets they will receive. Once you distribute all the property, debts, and expenses, you can now assign beneficiaries of the remaining estate.

- Assign guardians. Ensure to provide names of guardians responsible for taking care of pets, elders, or minors. Additionally, you can also designate funds to ease the burden on guardians.

- Assign signatures and witnesses. Every state differs in the number of witnesses needed and the criteria on who qualifies to be a witness. These witnesses will sign the Will, proving that you, the testator, are of sound mind and that they saw you sign the document willingly.

- Include self-proving affidavits. A self-proving document is a statement that proves the Last Will and Testament’s validity. You and your witnesses will sign the document in front of a notary. The Will might not necessarily have to include an affidavit to be legal. However, it will significantly expedite the process.

The elements to include in a Last Will and Testament

Overall, here’s what you will see in a will template.

- The executor and a backup executor are individuals with which the testator wants to settle affairs. Furthermore, they ensure the Will will be thoroughly carried out.

- The assets can refer to property or money. These are lands, houses, online accounts, domain names, and possible money in various online accounts.

- The beneficiaries refer to organizations and individuals from whom the testator wants to receive the properties and assets. They can be family, friends, charitable institutions, churches, universities, etc.

- Guardians will be responsible for caring for children or elders; suppose the testator and the spouse are deceased. Additionally, you can also assign pet caretakers and include them in the Will for those who have pets.

- A detailed outline of funeral wishes is necessary when filling out a will template. Include where and how you want to hold it and allocate funds. Furthermore, you also need to allocate money for any medication and hospital bills.

- Witnesses are essential to prove you are in an excellent state of mind while signing the Will. Some states require at least two witnesses. Others will require more.

The benefits

- You can leave the assets to those people you choose and trust. Without a Will, your assets will be subject to “intestacy.” This means that the individuals you would want to benefit from your property will only have little to nothing. Meanwhile, those you are not so close with will receive the majority of the assets. Using a Will, you get to choose beneficiaries accordingly.

- Name a guardian for children and allocate money for them. You can choose a guardian for those you will leave behind, especially kids and the elderly. Additionally, a Will will ensure that you set aside money to provide their comfort and support.

- You have the chance to plan and tend to personal matters. You can always use the Will to indicate the services you prefer, including other personal issues, from pet care to burial arrangements.

- It can be cost-efficient. The costs of processing a Will depends on various factors. However, it can be affordable, especially if your assets, finances, and beneficiaries are already straightforward. Additionally, a free will template can also be available to fill out online.

The drawbacks

- It becomes a public record. Once the will is filed for probate, anyone can search for the document and its contents. For those uncomfortable with declaring their assets to the public, this can be a concern.

- Possible challenges. You might also consider the potential people or parties who might challenge the Will. However, if you follow the proper process in coming up with the document, the Will, including the provision in it, will surely stand.

- May need to undergo probate. Suppose you have assets under the Will for more than a specific amount; it must be filed for probate. It’s a procedure where they distribute the decedent’s assets. This can take a more prolonged and costly process.

- May incur tax concerns. Suppose the will is not properly planned out, it could lead to most costs. This means that the estate involved might be open to paying large state or federal taxes. Besides that, the beneficiaries might also pay inheritance taxes. As a testator, you also need to consider this matter before filing the Will.

FAQs

Q1: Can my spouse and I have a single Will?

A1: A Joint or Mutual Will is possible for you and your spouse. By the time a spouse passes away, the surviving one tains the assets. The downside of having a Joint Will is that the surviving spouse can’t make amendments to the Will after the partner has passed away. Others create Mirror Wills. This means that each spouse has separate Will that are nearly identical.

Q2: Can a testator make amendments to the Will?

A2: Yes. In general, you need to utilize the “codicil.” Testators usually amend the will for reasons including change of executor, beneficiaries, personal representative, or any other aspect that affects the estate transfer. You need to attach the Codicil to the Will and sign them under State law.

Q3: Can I revoke my Last Will and Testament?

A3: Yes. If you find that the Will fails to represent your preferences and interests, you can start over.

Q4: What is a Trust?

A4: A trust refers to a pool of assets like investments, cash, property, etc. These various assets are placed in a trust for a specific beneficiary, usually a spouse or a child. You usually appoint a trustee to supervise its management. Additionally, you create trust while still alive; you can act as both the beneficiary and trustee. This allows you to decide how to distribute assets after death while having access to all the assets now.