Introduction

Whether you are a kind, giving person or a serious business establishment, the transaction of lending money with the hopes of getting it back needs to be documented.

As a lender, you need to sit down and agree with the borrower on how much will be paid back, in what installments, and when the installment will be made.

This is where having a payment agreement contract is of paramount importance. With a payment agreement template, you are saved the headache of wondering how much you are being owed.

The template helps you avoid possible payment disputes with debtors while also acting as a point of reference to buttress your case in any legal proceeding.

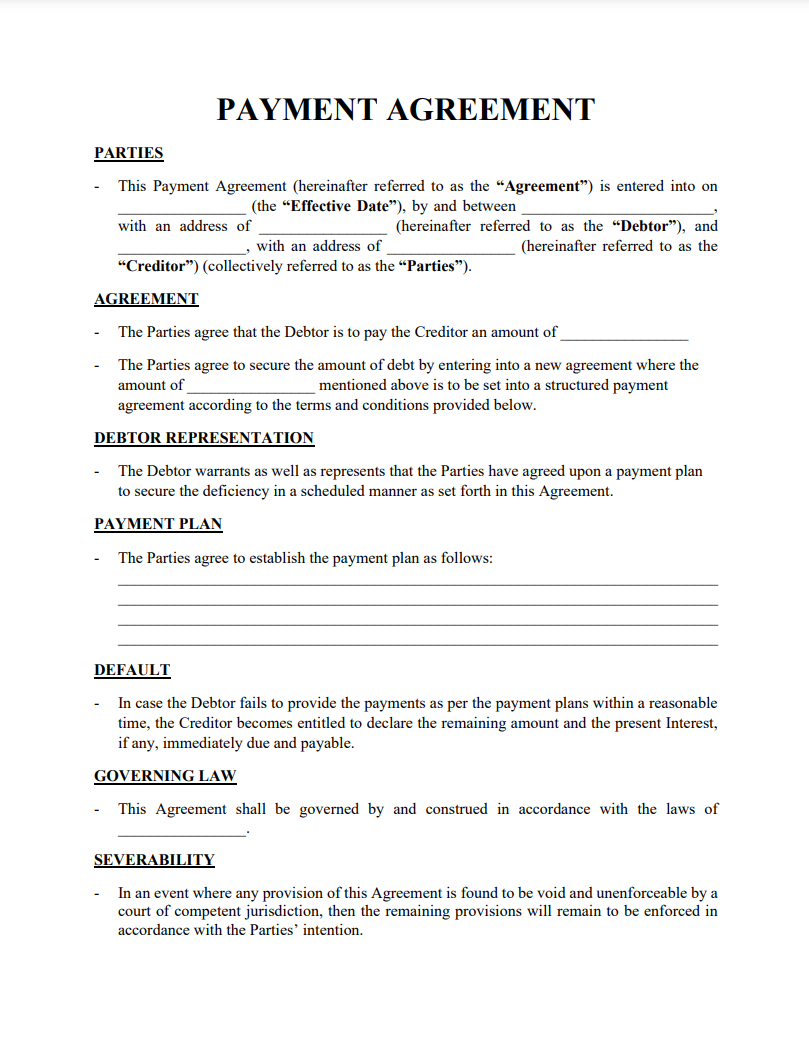

What is a payment agreement?

First, a payment agreement can be described as a legally binding contract between two main parties: a creditor or lender and a debtor or payer. This contract provides details of the amount of money that the creditor has lent out and the installment payment schedule that the borrower has agreed to.

A real-world scenario for a payment agreement is where Jim lends Frank a sum of USD$2,000. Jim then draws up a payment agreement for Frank to pay back this sum without interest over four months. Frank agrees to pay back the sum of USD$500 each month for four months. Both parties append their names, signatures, and the date of agreeing to the payment agreement document, sealing the contract.

While the scenario mentioned above involves a payment agreement between individuals, payment agreements can be reached between corporate entities or commercial transactions.

Why is a payment agreement important?

A payment agreement contract is important in this day and age for the following reasons:

- Avoidance of ambiguity: A payment agreement contract is simple to draw up. It spells out how much is being owed, how much is expected to be paid back, and the installment payment schedule. All parties to the contract are fully aware of the unequivocal terms.

- Avoidance of disputes: Without a payment agreement, payment disputes are likely to break out between the creditor and debtor. Using a payment agreement template can help you avoid any future disputes with your debtors.

- Estate management: Having documented payment agreements can help properly manage your estate. A debt owed is just as good as an asset, and a payment agreement contract ensures that your estate receives the monies owed to you even when you are deceased.

- Legal recourse: A payment agreement contract is legally binding to the parties concerned. With a payment agreement contract, you can seek legal recourse if a debtor is unable or unwilling to honor the terms of the payment agreement contract.

- Limits defaulters: With a payment agreement contract, you will limit the number of bad debts or defaulters you attract. This is especially true if you are a professional money lender. A client would be reluctant to sign up for a payment agreement if they know that they would default.

Important Elements / Clauses for Payment Agreements

A typical payment agreement template consists of the following key elements:

- The amount owed or debt: The amount owed by the debtor is clearly stated and is key to the contract.

- The installment repayment schedule: A payment agreement contract shows the agreed repayment schedule. For example, Frank pays USD$500 on the 10th of each month for the next four months (January, February, March, and April).

- Default T&Cs and penalties: It is not unusual for debtors to default in a payment agreement contract. The default could be a failure to pay the agreed installment payment amount or a failure to pay as at when due. It is important to state the T&Cs and penalties for default. For example, a default could result in interest payment on the principal sum.

- Possible amendments to the payment agreement: A good payment agreement template should include provisions for amending the contract terms due to unforeseen circumstances, such as; illness, death, bankruptcy, etc.

- Appending signatures and dates: To seal the payment agreement contract, both parties (the creditor and the debtor) need to append their signatures and dates to the payment agreement document. This makes the contract legally binding to both parties.

Best practices for payment agreements

A payment agreement contract indicates your level of professionalism, accountability, transparency, and seriousness. It also protects you or your business in the event of a default, as you can seek legal recourse if needed.

To this end, you need to always adhere to the best practices for payment agreements, and some of these include the following:

- Ensure that the owed amount is clearly indicated in the contract.

- State the right dates, including the date of the loan disbursement, the date for installment payments, and the date of signing the payment agreement contract by all parties involved.

- Clearly state T&Cs of repayment, including default terms, penalties, and any other specific condition or detail(s) that are crucial to the payment agreement contract.

- Ensure that the payment agreement is in-tune with what is permissible under your locality or state of residence and/or operation laws.

Our payment agreement template is professionally designed to help you meet all possible best practices when drawing up a payment agreement contract.

FAQ

Q1: Is it necessary to have a witness to a payment agreement?

A1: The ideal scenario will be to have a third party serving as a witness to the signing of the payment agreement by the parties involved. However, having a witness to a payment agreement contract is not legally necessary.

Q2: Is a payment agreement contract really necessary?

A2: A payment agreement contract is necessary if you want to get back what is owed to you. You may be able to get paid without default, or you may need to seek legal recourse. If the latter is the case, then a payment agreement is admissible in court as a point of reference in a legal proceeding.

Q3: Can a payment agreement contract be terminated, and how can I go about it?

A3: Yes. A payment agreement contract can be terminated in the following ways:

- Once a debtor has settled all outstanding debts to you, the creditor.

- Where the T&Cs of the contract have been breached by either or both parties to the agreement.

- Where all parties to the payment agreement come to a decision to terminate the contract.

Q4: What are the key elements of a payment agreement contract?

A4: A typical payment agreement template should include the following information and details:

- Names of all parties to the contract,

- The address of the parties,

- The date of the payment agreement contract,

- The amount owed or debt,

- The repayment schedule,

- A clause for amendments to the contract,

- T&Cs and penalties for default in repayment,

- A clause indicating the steps to be taken towards the settlement of disputes,

- A section where all parties append their signatures and date of the agreement.

Q5: Is it possible for me to edit the payment agreement template?

A5: Yes. Our payment agreement template is provided as an editable Word document. You can make amendments to the template to suit your peculiar payment agreement contract needs. However, we advise that you consult a lawyer to ensure that all amendments are in accordance with the prevailing laws in your locality or state of residence/operation.