What are Porter’s Five Forces?

Porter's Five Forces is a powerful framework for analyzing the competitive forces within an industry and determining its attractiveness. Developed by Michael E. Porter, a Harvard Business School professor, the model identifies five key forces that shape industry competition and influence profitability. These forces help businesses understand the dynamics of their competitive environment, identify potential threats and opportunities, and develop effective strategies. First published in Porter's 1980 book, Competitive Strategy: Techniques for Analyzing Industries and Competitors, the framework remains a cornerstone of strategic analysis.

What are the five forces?

The five forces are as follows:

- Rivalry among existing competitors

- Threat of new entrants

- Bargaining power of suppliers

- Bargaining power of buyers

- Threat of substitute products or services

Rivalry among existing competitors

Rivalry among existing competitors is the intensity of competition between companies already operating in the industry. High rivalry can lead to price wars, aggressive marketing campaigns, and constant innovation. Factors that increase rivalry include:

- Many competitors: A large number of players in the market intensifies competition.

- Slow industry growth: When the market isn't growing rapidly, companies must compete more fiercely for market share.

- Low product differentiation: If products are similar, price becomes the primary competitive factor.

- High exit barriers: If it's costly or difficult for companies to leave the market, they are more likely to engage in aggressive competition.

Threat of new entrants

The threat of new entrants refers to the ease with which new companies can enter the market. High barriers to entry protect existing players and limit competition. Key barriers include:

- Economies of scale: Large-scale production gives established companies a cost advantage.

- Capital requirements: Significant upfront investment can deter new entrants.

- Access to distribution channels: Existing companies may have established distribution networks that are difficult for new entrants to access.

- Government regulations: Regulations and licensing requirements can create barriers to entry.

- Brand loyalty: Strong brand loyalty makes it difficult for new entrants to attract customers.

Bargaining power of buyers

The bargaining power of buyers (customers) refers to the ability of customers to influence the prices and terms of purchase. Buyers have high bargaining power when:

- Few buyers exist, or buyers purchase in large volumes: Concentrated buying power gives buyers more leverage.

- Many suppliers exist: If there are many suppliers offering similar products, buyers have more choices and thus more power.

- Low switching costs for buyers: If it's easy for buyers to switch to a different supplier, they have more bargaining power.

- Buyers can integrate backward into the supplier's industry: If buyers can easily produce the product themselves, they have increased bargaining power.

- Products are undifferentiated: If products are similar, buyers are more price-sensitive.

Threat of substitute products or services

The threat of substitute products or services refers to the availability of alternative products or services that can satisfy the same customer need. A high threat of substitutes limits an industry's profit potential. Factors that increase the threat of substitutes include:

- Availability of close substitutes: The more readily available substitutes are, the higher the threat.

- Price and performance of substitutes: If substitutes offer a comparable or better value proposition (price-performance ratio), the threat is higher.

- Low switching costs for buyers: If it's easy for buyers to switch to a substitute, the threat is higher.

When should Porter’s 5 forces analysis be used?

This framework should be used whenever a business is trying to understand its market, usually because they want to introduce a new product or service. The analysis can be used to develop educated predictions about how well that new product or service might perform and what market tensions it is likely to face.

It’s important to remember that markets are fluid, not static. All aspects are currently changing, from consumer demand and supply to existing competition. Therefore this framework is designed to be used more than once, and can be revised every time significant market change occurs.

Top 10 Porter's 5 Forces Examples for Students

To solidify your understanding of Porter's Five Forces, let's delve into real-world applications. The following examples illustrate how these forces shape competitive dynamics across various industries, providing valuable insights for strategic decision-making.

Example 1: The Smartphone Industry: Samsung

Our first example takes us into the dynamic world of consumer technology: the smartphone industry, with a focus on Samsung.

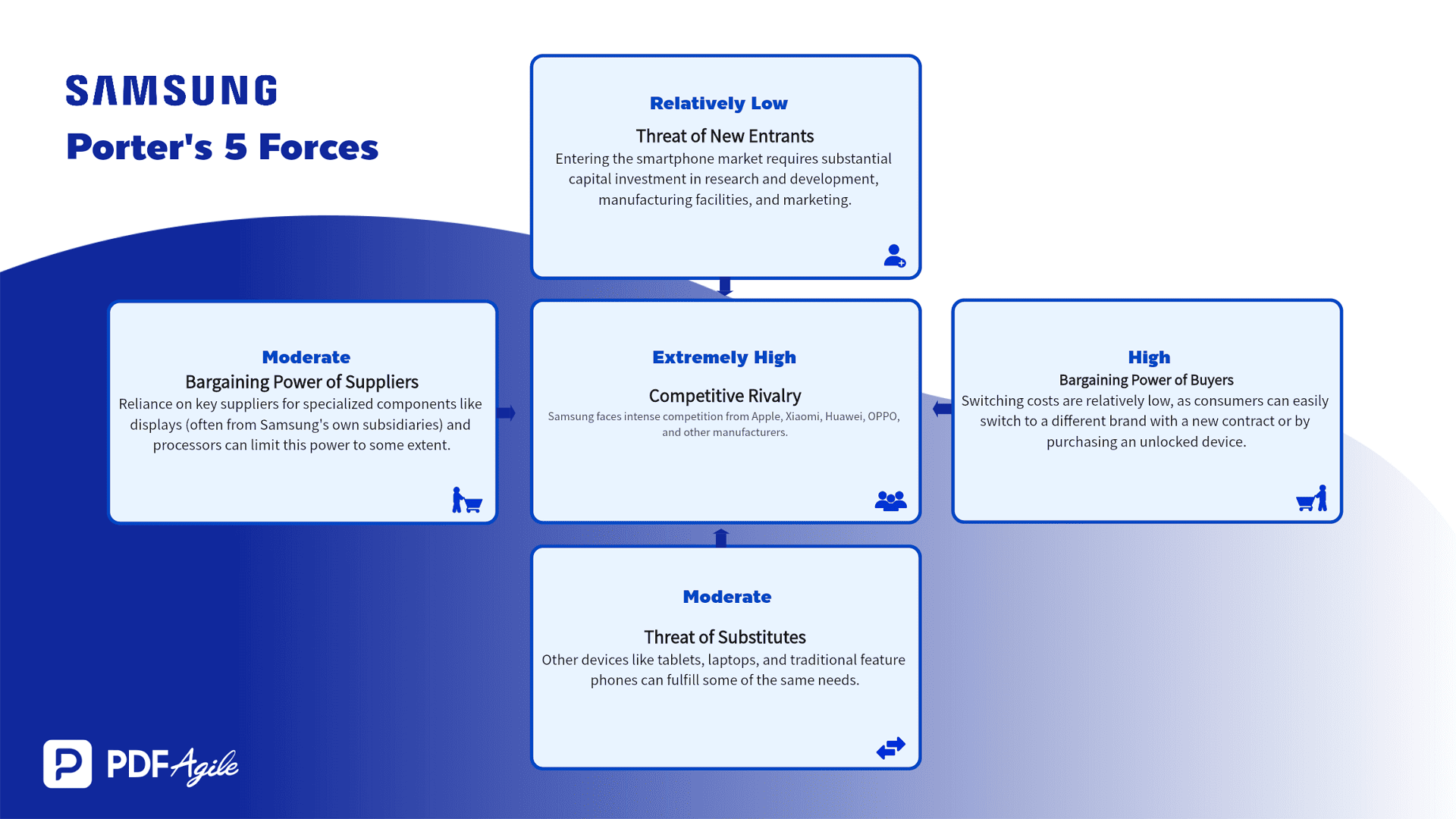

- Industry/Company: The Smartphone Industry: Samsung

- Rivalry among existing competitors: Extremely high. Samsung faces intense competition from Apple, Xiaomi, Huawei, OPPO, and other manufacturers. This rivalry manifests in constant innovation cycles (new features, improved cameras, faster processors), aggressive marketing campaigns, and price competition, especially in different market segments (high-end vs. budget).

- Threat of new entrants: Relatively low. Entering the smartphone market requires substantial capital investment in research and development, manufacturing facilities, and marketing. Established brands also benefit from strong brand loyalty and economies of scale, making it difficult for newcomers to compete.

- Bargaining power of suppliers: Moderate. Samsung, as a large-scale manufacturer, has significant bargaining power with many component suppliers. However, reliance on key suppliers for specialized components like displays (often from Samsung's own subsidiaries) and processors can limit this power to some extent. Shortages of key components, such as microchips, can also temporarily shift the balance of power toward suppliers.

- Bargaining power of buyers: High. Consumers have a wide range of choices across different brands and price points. Switching costs are relatively low, as consumers can easily switch to a different brand with a new contract or by purchasing an unlocked device. This high buyer power forces manufacturers like Samsung to constantly innovate and offer competitive pricing.

- Threat of substitute products or services: Moderate. While there are no direct substitutes for the core functionality of a smartphone (mobile communication, internet access, apps), other devices like tablets, laptops, and traditional feature phones can fulfill some of the same needs. However, the increasing convergence of these devices with smartphones has blurred these lines.

Example 2: The Coffee Industry: Starbucks

From the digital world to the everyday ritual of coffee consumption, let's analyze Starbucks' position within the coffee industry.

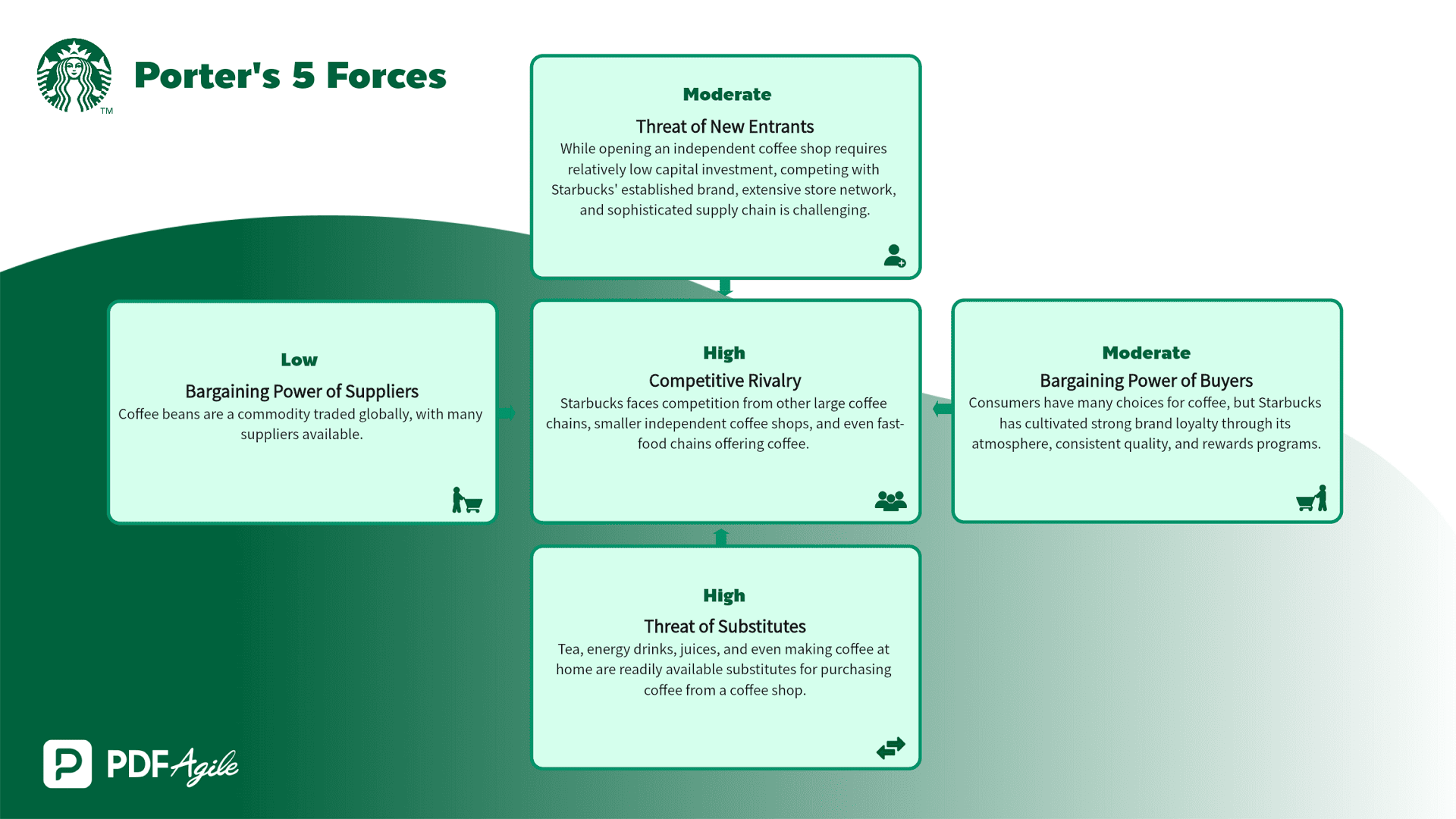

- Industry/Company: The Coffee Industry: Starbucks

- Rivalry among existing competitors: High. Starbucks faces competition from other large coffee chains (e.g., Dunkin', Costa Coffee), smaller independent coffee shops, and even fast-food chains offering coffee (e.g., McDonald's). This competition drives innovation in new beverages, store formats, and loyalty programs.

- Threat of new entrants: Moderate. While opening an independent coffee shop requires relatively low capital investment, competing with Starbucks' established brand, extensive store network, and sophisticated supply chain is challenging. However, the rise of specialty coffee shops and local roasters presents a constant threat.

- Bargaining power of suppliers: Relatively low. Coffee beans are a commodity traded globally, with many suppliers available. This gives Starbucks significant bargaining power to negotiate favorable prices. However, factors like weather patterns and political instability in coffee-producing regions can influence supply and temporarily increase supplier power.

- Bargaining power of buyers: Moderate. Consumers have many choices for coffee, but Starbucks has cultivated strong brand loyalty through its atmosphere, consistent quality, and rewards programs. This gives them some pricing power, although price sensitivity remains a factor, especially in comparison to cheaper alternatives like brewing coffee at home.

- Threat of substitute products or services: High. Tea, energy drinks, juices, and even making coffee at home are readily available substitutes for purchasing coffee from a coffee shop. This high threat of substitutes puts pressure on Starbucks to maintain competitive pricing and offer unique value propositions.

Read Also: Starbucks Porters Five Forces Analysis

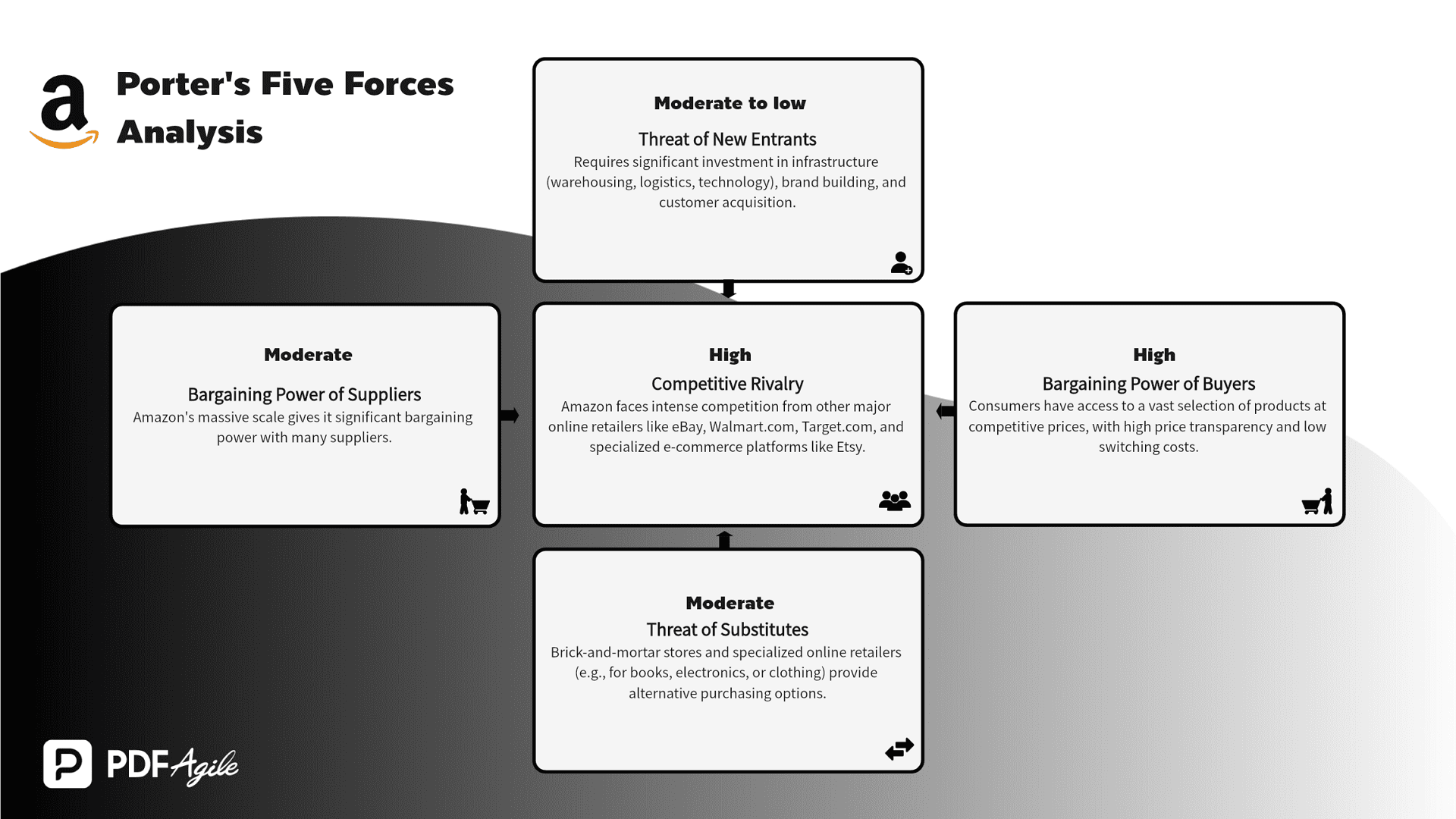

Example 3: The E-commerce Industry: Amazon

Now, let's shift our focus to the transformative force of e-commerce, examining the dominant player: Amazon.

- Industry/Company: The E-commerce Industry: Amazon

- Rivalry among existing competitors: High. Amazon faces intense competition from other major online retailers like eBay, Walmart.com, Target.com, and specialized e-commerce platforms like Etsy. This competition manifests in pricing strategies, product selection, delivery speed, and customer service.

- Threat of new entrants: Moderate to low. Establishing a comprehensive e-commerce platform requires significant investment in infrastructure (warehousing, logistics, technology), brand building, and customer acquisition. This creates substantial barriers to entry for new players.

- Bargaining power of suppliers: Moderate. Amazon's massive scale gives it significant bargaining power with many suppliers. However, dependence on key brands and suppliers for certain product categories can limit this power. Furthermore, the increasing trend of direct-to-consumer sales by brands is also impacting Amazon’s supplier power.

- Bargaining power of buyers: High. Consumers have access to a vast selection of products at competitive prices, with high price transparency and low switching costs. This gives buyers significant leverage and forces Amazon to constantly focus on competitive pricing and excellent customer service.

- Threat of substitute products or services: Moderate. While e-commerce has disrupted traditional retail, brick-and-mortar stores and specialized online retailers (e.g., for books, electronics, or clothing) still provide alternative purchasing options. Furthermore, services like subscription boxes can also be viewed as substitutes for some e-commerce purchases.

Read Also: Amazon Porters Five Forces Analysis

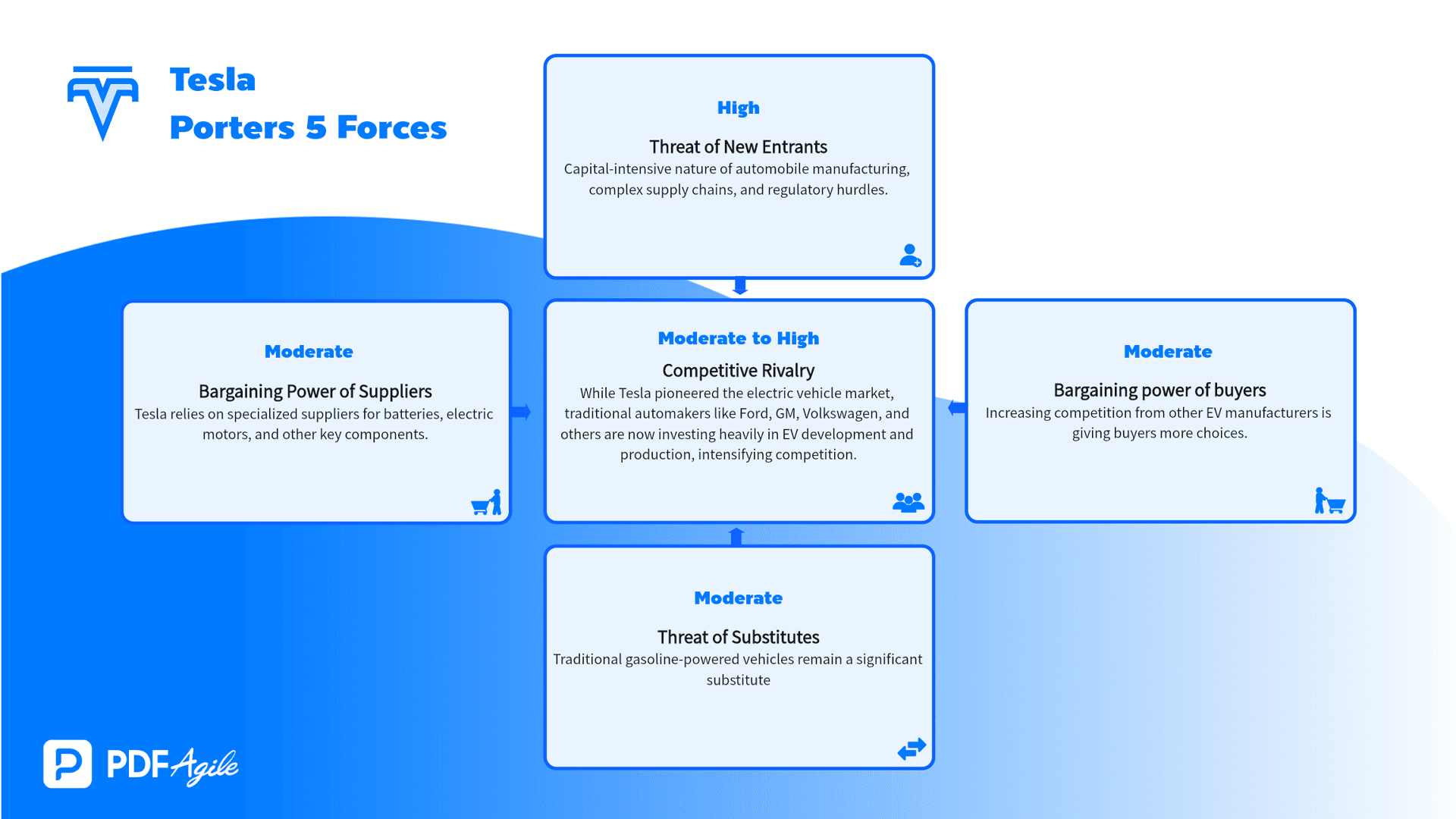

Example 4: The Automobile Industry: Tesla

Now let's examine the evolving landscape of the automobile industry, focusing on the innovative electric vehicle manufacturer: Tesla.

- Industry/Company: The Automobile Industry: Tesla

- Rivalry among existing competitors: Increasing. While Tesla pioneered the electric vehicle market, traditional automakers like Ford, GM, Volkswagen, and others are now investing heavily in EV development and production, intensifying competition.

- Threat of new entrants: Relatively high barriers due to the capital-intensive nature of automobile manufacturing, complex supply chains, and regulatory hurdles. However, new entrants specializing in niche EV segments or leveraging new technologies could still emerge.

- Bargaining power of suppliers: Moderate. Tesla relies on specialized suppliers for batteries, electric motors, and other key components. While Tesla's increasing production volume gives it some bargaining power, dependence on key suppliers and potential supply chain disruptions can limit this power.

- Bargaining power of buyers: Moderate. While Tesla has cultivated strong brand loyalty and a dedicated customer base, increasing competition from other EV manufacturers is giving buyers more choices. Price sensitivity is also a factor, particularly as more affordable EV models become available.

- Threat of substitute products or services: Moderate. Traditional gasoline-powered vehicles remain a significant substitute, although the increasing adoption of EVs and growing concerns about environmental impact are shifting consumer preferences. Public transportation, ride-sharing services, and other forms of transportation also serve as substitutes.

Read Also: Tesla Porters Five Forces Analysis

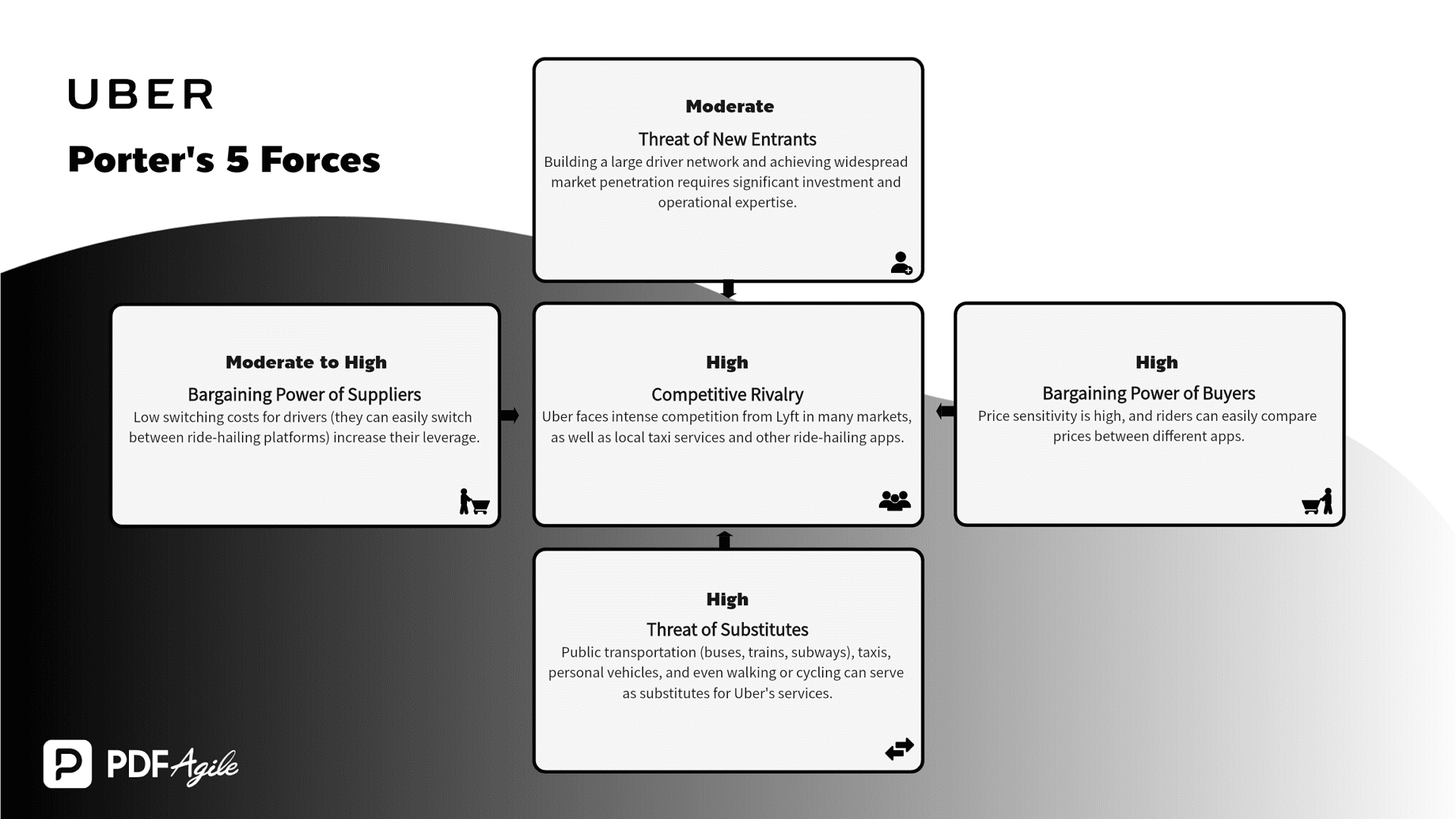

Example 5: The Transportation Industry: Uber

Shifting gears to the modern landscape of personal transportation, let's analyze the ride-hailing giant, Uber.

- Industry/Company: The Transportation Industry: Uber

- Rivalry among existing competitors: High. Uber faces intense competition from Lyft in many markets, as well as local taxi services and other ride-hailing apps. This competition manifests in pricing strategies, driver incentives, and marketing campaigns.

- Threat of new entrants: Moderate. While developing a ride-hailing app is relatively straightforward, building a large driver network and achieving widespread market penetration requires significant investment and operational expertise. Regulatory hurdles and local licensing requirements can also act as barriers to entry in certain markets.

- Bargaining power of suppliers (drivers): Moderate to high. Drivers are essential to Uber's business model, and they have some bargaining power, especially during peak demand periods. Low switching costs for drivers (they can easily switch between ride-hailing platforms) further increase their leverage.

- Bargaining power of buyers (riders): High. Riders have many choices between different ride-hailing services, taxis, and public transportation. Price sensitivity is high, and riders can easily compare prices between different apps. This high buyer power forces Uber to maintain competitive pricing and offer various promotions.

- Threat of substitute products or services: High. Public transportation (buses, trains, subways), taxis, personal vehicles, and even walking or cycling can serve as substitutes for Uber's services. The availability and convenience of these substitutes vary depending on the location.

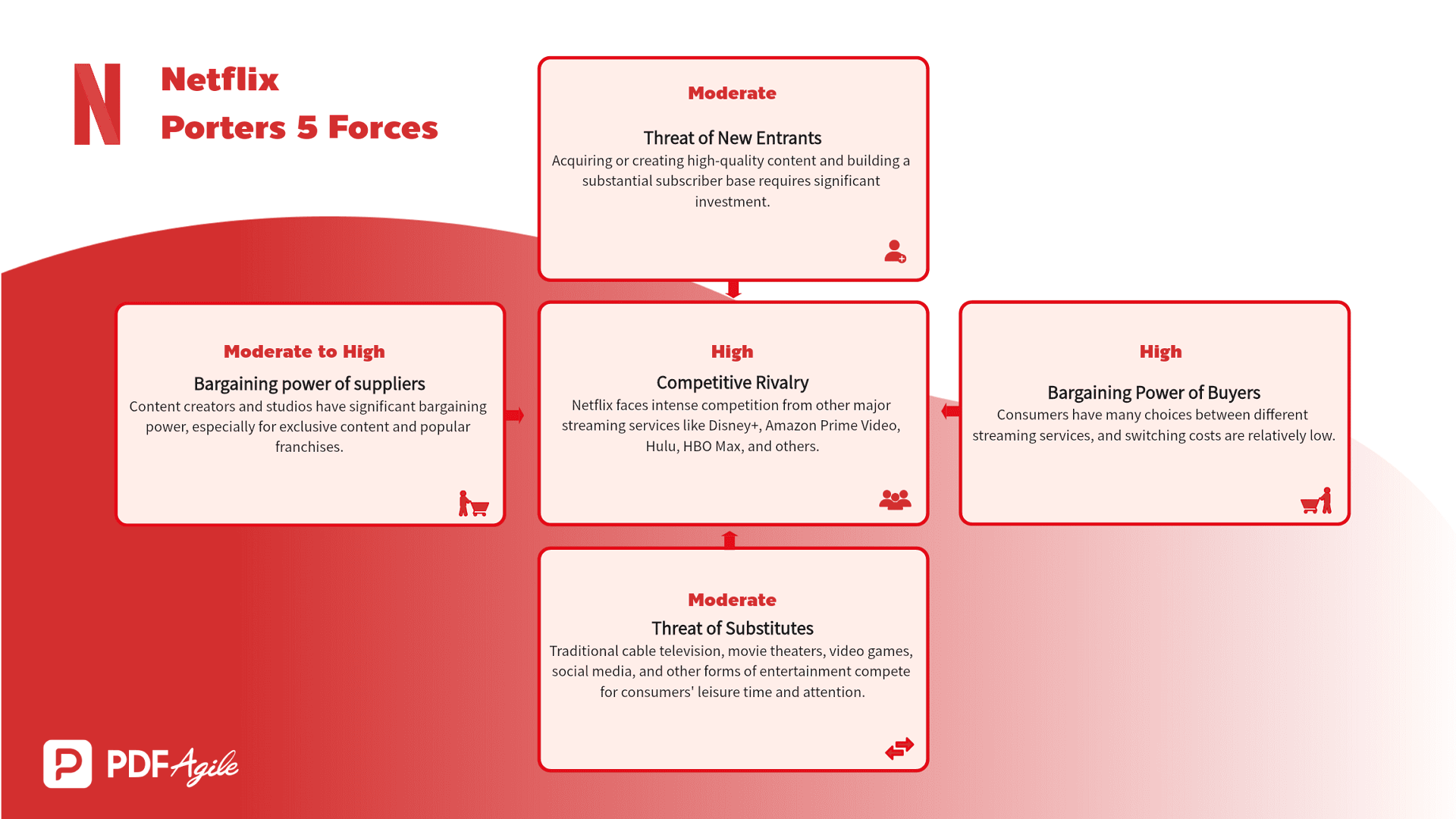

Example 6: The Video Streaming Services Industry: Netflix

From transportation to entertainment, let's explore the dynamic world of video streaming, focusing on the pioneering platform, Netflix.

- Industry/Company: The Video Streaming Services Industry: Netflix

- Rivalry among existing competitors: High. Netflix faces intense competition from other major streaming services like Disney+, Amazon Prime Video, Hulu, HBO Max, and others. This competition is driven by content acquisition and creation, pricing strategies, and user experience.

- Threat of new entrants: Moderate. While the barrier to entry for launching a streaming service is relatively low (compared to traditional media), acquiring or creating high-quality content and building a substantial subscriber base requires significant investment. The increasing fragmentation of the streaming market also makes it more challenging for new entrants to gain traction.

- Bargaining power of suppliers (content creators/studios): Moderate to high. Content creators and studios have significant bargaining power, especially for exclusive content and popular franchises. Netflix's reliance on licensed content makes it vulnerable to price increases and potential content withdrawals by suppliers. However, Netflix's increasing investment in original content is gradually reducing this dependence.

- Bargaining power of buyers (subscribers): High. Consumers have many choices between different streaming services, and switching costs are relatively low. This high buyer power forces Netflix to constantly invest in new content, improve its user interface, and offer competitive pricing plans.

- Threat of substitute products or services: Moderate. Traditional cable television, movie theaters, video games, social media, and other forms of entertainment compete for consumers' leisure time and attention. However, the convenience and on-demand nature of streaming services have made them a popular choice for many viewers.

Read Also: Netflix Porters Five Forces Analysis

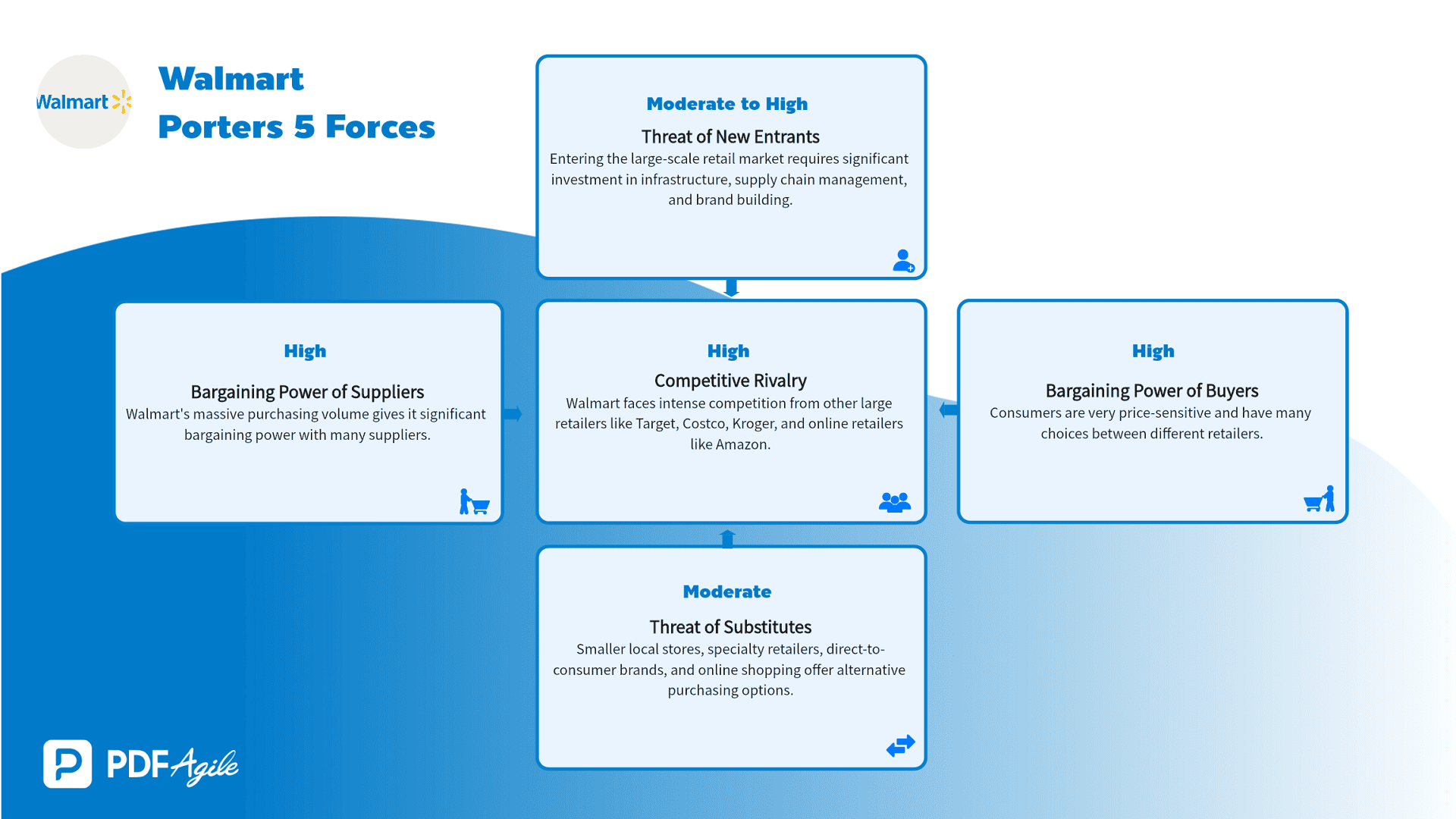

Example 7: The Retail Industry: Walmart

Moving to the realm of retail, let's analyze the strategies of the world's largest retailer, Walmart.

- Industry/Company: The Retail Industry: Walmart

- Rivalry among existing competitors: High. Walmart faces intense competition from other large retailers like Target, Costco, Kroger, and online retailers like Amazon. This competition is driven by pricing strategies, product selection, store locations, and supply chain efficiency.

- Threat of new entrants: Moderate to high. Entering the large-scale retail market requires significant investment in infrastructure (distribution centers, store locations), supply chain management, and brand building. However, smaller niche retailers and online marketplaces can still pose a threat.

- Bargaining power of suppliers: High. Walmart's massive purchasing volume gives it significant bargaining power with many suppliers. However, dependence on key brands and suppliers for certain product categories can limit this power to some extent.

- Bargaining power of buyers (consumers): High. Consumers are very price-sensitive and have many choices between different retailers. Low switching costs and price transparency further increase buyer power.

- Threat of substitute products or services: Moderate. Smaller local stores, specialty retailers, direct-to-consumer brands, and online shopping offer alternative purchasing options. Changes in consumer preferences and shopping habits also influence the competitive landscape.

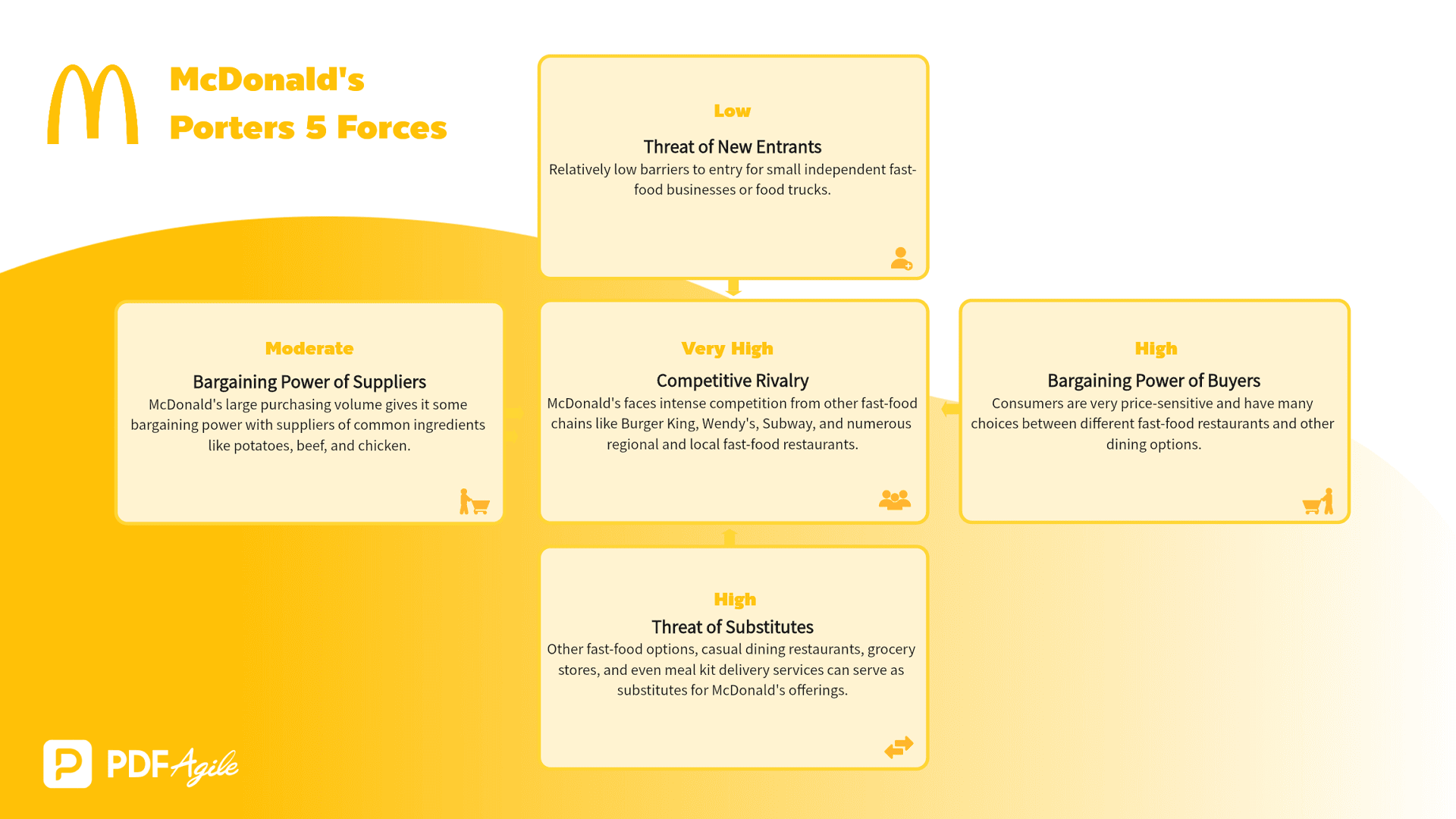

Example 8: The Fast Food Industry: McDonald's

Now let's take a look at the fast-paced world of quick-service restaurants, focusing on the iconic brand, McDonald's.

- Industry/Company: The Fast Food Industry: McDonald's

- Rivalry among existing competitors: Very high. McDonald's faces intense competition from other fast-food chains like Burger King, Wendy's, Subway, and numerous regional and local fast-food restaurants. This competition is driven by pricing, menu innovation, marketing campaigns, and store locations.

- Threat of new entrants: Relatively low barriers to entry for small independent fast-food businesses or food trucks. However, competing with McDonald's established brand, extensive store network, and efficient supply chain is challenging.

- Bargaining power of suppliers: Moderate. McDonald's large purchasing volume gives it some bargaining power with suppliers of common ingredients like potatoes, beef, and chicken. However, reliance on agricultural commodities can make them vulnerable to price fluctuations and supply chain disruptions.

- Bargaining power of buyers (consumers): High. Consumers are very price-sensitive and have many choices between different fast-food restaurants and other dining options. Low switching costs further increase buyer power.

- Threat of substitute products or services: High. Other fast-food options, casual dining restaurants, grocery stores (for cooking at home), and even meal kit delivery services can serve as substitutes for McDonald's offerings.

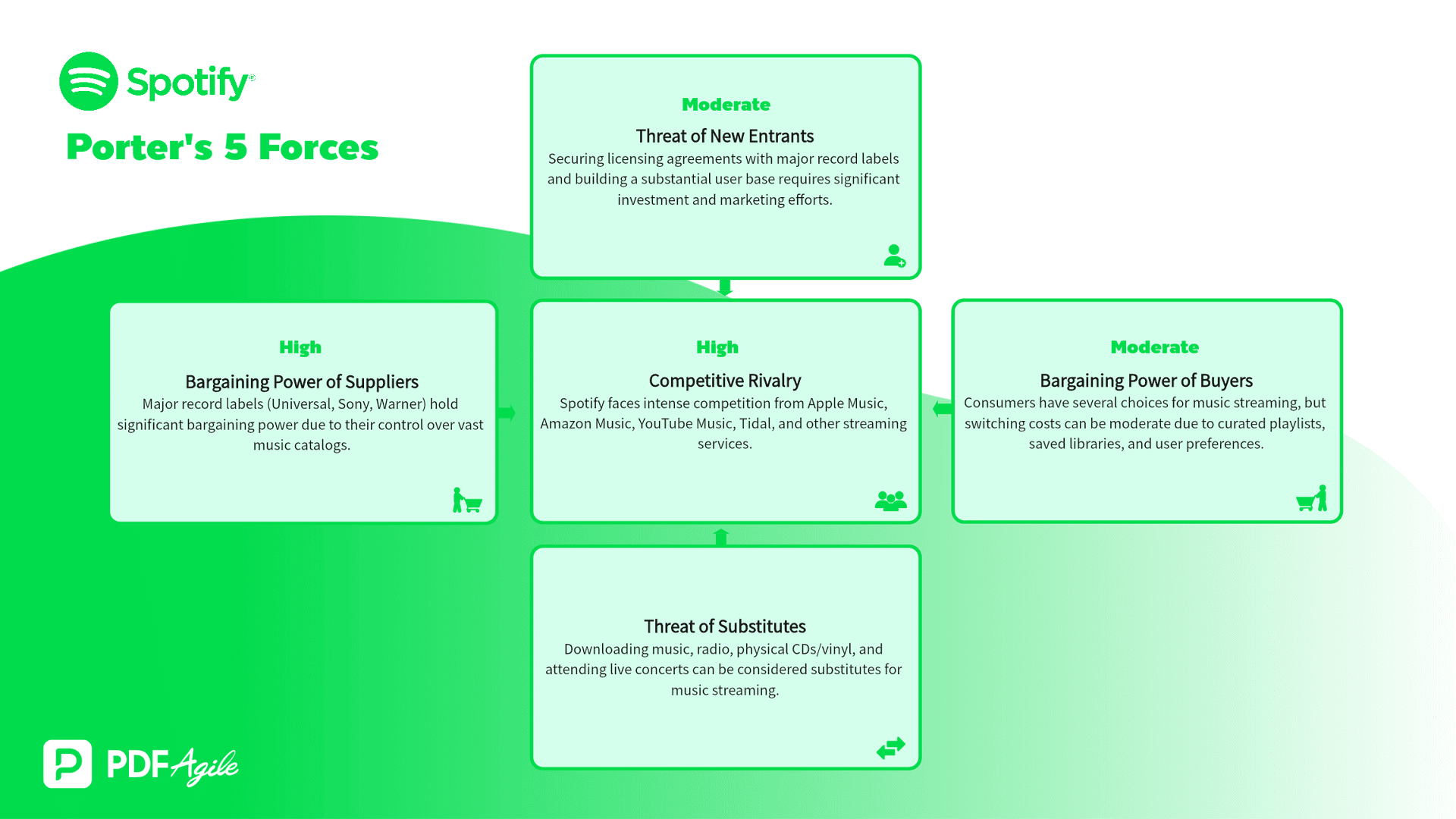

Example 9: The Music Streaming Industry: Spotify

Let's move into the realm of digital music and examine the dominant force in music streaming: Spotify.

- Industry/Company: The Music Streaming Industry: Spotify

- Rivalry among existing competitors: High. Spotify faces intense competition from Apple Music, Amazon Music, YouTube Music, Tidal, and other streaming services. This competition is driven by music library size, exclusive content (podcasts, artist exclusives), pricing, user interface, and audio quality.

- Threat of new entrants: Moderate. While the barrier to entry for launching a music streaming service is relatively low technically, securing licensing agreements with major record labels and building a substantial user base requires significant investment and marketing efforts. The established players have strong network effects, making it challenging for new entrants to gain traction.

- Bargaining power of suppliers (record labels/artists): High. Major record labels (Universal, Sony, Warner) hold significant bargaining power due to their control over vast music catalogs. Artists also have increasing influence, especially popular ones who can negotiate exclusive deals or choose to release music independently. This high supplier power significantly impacts Spotify's profit margins and business model.

- Bargaining power of buyers (subscribers): Moderate. Consumers have several choices for music streaming, but switching costs can be moderate due to curated playlists, saved libraries, and user preferences. However, price sensitivity and the availability of free or ad-supported tiers on some platforms give buyers some leverage.

- Threat of substitute products or services: Moderate. Downloading music (though declining in popularity), radio, physical CDs/vinyl, and attending live concerts can be considered substitutes for music streaming. However, the convenience and accessibility of streaming services have made them a dominant force in music consumption.

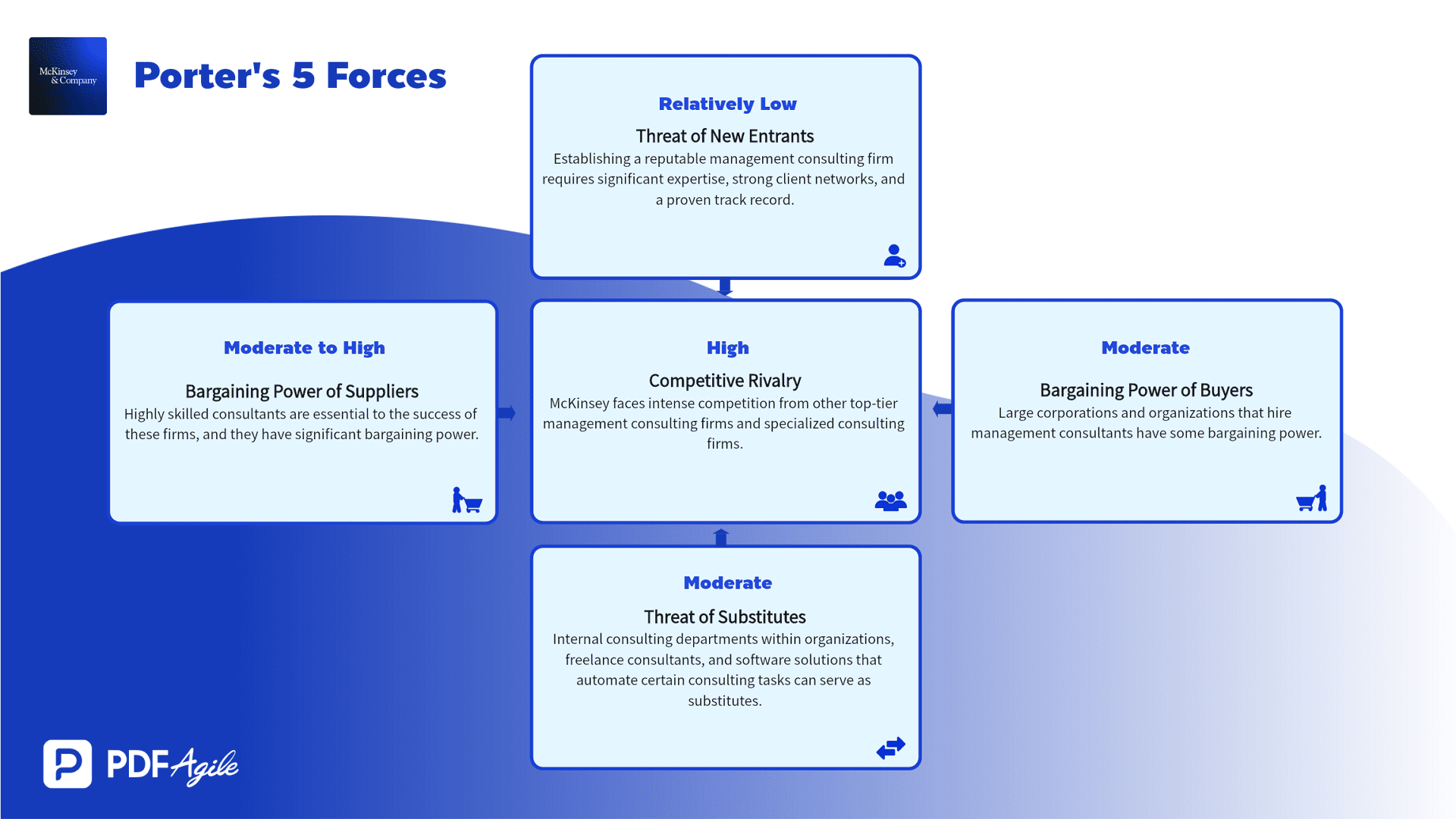

Example 10: The Consulting Industry (Management Consulting): McKinsey & Company

For our final example, let's move into the professional services sector and analyze a leading management consulting firm: McKinsey & Company.

- Industry/Company: The Consulting Industry (Management Consulting): McKinsey & Company

- Rivalry among existing competitors: High. McKinsey faces intense competition from other top-tier management consulting firms (e.g., Boston Consulting Group (BCG), Bain & Company) and specialized consulting firms. Competition is based on reputation, expertise, client relationships, and project success.

- Threat of new entrants: Relatively low. Establishing a reputable management consulting firm requires significant expertise, strong client networks, and a proven track record. Building a brand and attracting top talent also presents substantial barriers to entry.

- Bargaining power of suppliers (consultants/employees): Moderate to high. Highly skilled consultants are essential to the success of these firms, and they have significant bargaining power, especially those with specialized expertise or strong client relationships.

- Bargaining power of buyers (businesses/organizations): Moderate. Large corporations and organizations that hire management consultants have some bargaining power, especially for large-scale projects. However, the specialized expertise and reputation of top-tier firms like McKinsey give them some pricing power.

- Threat of substitute products or services: Moderate. Internal consulting departments within organizations, freelance consultants, and software solutions that automate certain consulting tasks can serve as substitutes. However, the comprehensive expertise and strategic insights offered by top-tier consulting firms often justify their higher fees.

Get Started with Porter's Five Forces Template

Now that you've seen how Porter's Five Forces analysis can illuminate the competitive landscape, it's time to put it into practice. Download our free Porter's Five Forces Template and customize it to analyze your own industry or business with PDF Agile:

Link to Porter's Five Forces Template >>

This template provides a structured format to capture your analysis of each force, facilitating a comprehensive and organized assessment.

Bonus! Download All 10 Porter's Five Forces Examples in PDF Format

Want to keep all these examples handy for future reference and inspiration? We've compiled all 10 expanded Porter's Five Forces examples into a convenient PDF document, perfect for easy sharing and offline access.

Link to Download All 10 Porter's Five Forces Examples PDF >>