Cash receipts are vital documents when it comes to business and personal financial transactions. Besides that, cash receipts are proof of payment; they are issued for accounting and bookkeeping purposes. The cash receipt may be defined as a written document representing the cash received against some particular goods or services. It is usually evidence for some form of transaction where cash is paid, usually in liquid cash. Businesses issue cash receipts for any cash that their customers pay to them in cash as a way of ensuring accountability and transparency in such a financial transaction. If you happen to be new about what a cash receipt is and how it works, the information given in this write-up will open your eyes to it.

Key Characteristics of Cash Receipt

- Proof of Payment: Cash receipts are proof that some sort of transaction has taken place, and thus may be used in cases of dispute or purchase verification.

- Legal document: Cash receipts are legally binding and, thus, can be taken to court if the need should arise.

- Record keeping: They are very important in keeping and maintaining proper books of account, which usually is essential for accounting purposes.

- Transaction information: date of transaction, the amount that was received, and what has been provided against the received amount.

When Are Cash Receipts Used?

Some of the situations where cash receipt is used:

- Retail transactions: If a customer buys goods from a store or avails any services and pays for it in cash, then a cash receipt is given

- Service payments: The plumber, electrician, and any person belonging to the service-providing departments will give cash receipts once the payment has been made.

- Event ticket sale: Cash receipts are sometimes given when tickets to a particular event, concert, or show are sold

- Rent receipt: Cash receipt is sometimes given by the landlord upon cash payment

Difference between cash receipts and other kinds of receipt

While cash receipts deal with cash, other forms of receipt involve:

- Credit card receipts: They are issued in cases when the payment was made by credit card and hence detail the card type.

- Electronic payment receipts: They are generated in case of transactions through digital wallets or bank transfers.

- Invoice: On the other hand, invoices are bills that request payment instead of confirming it.

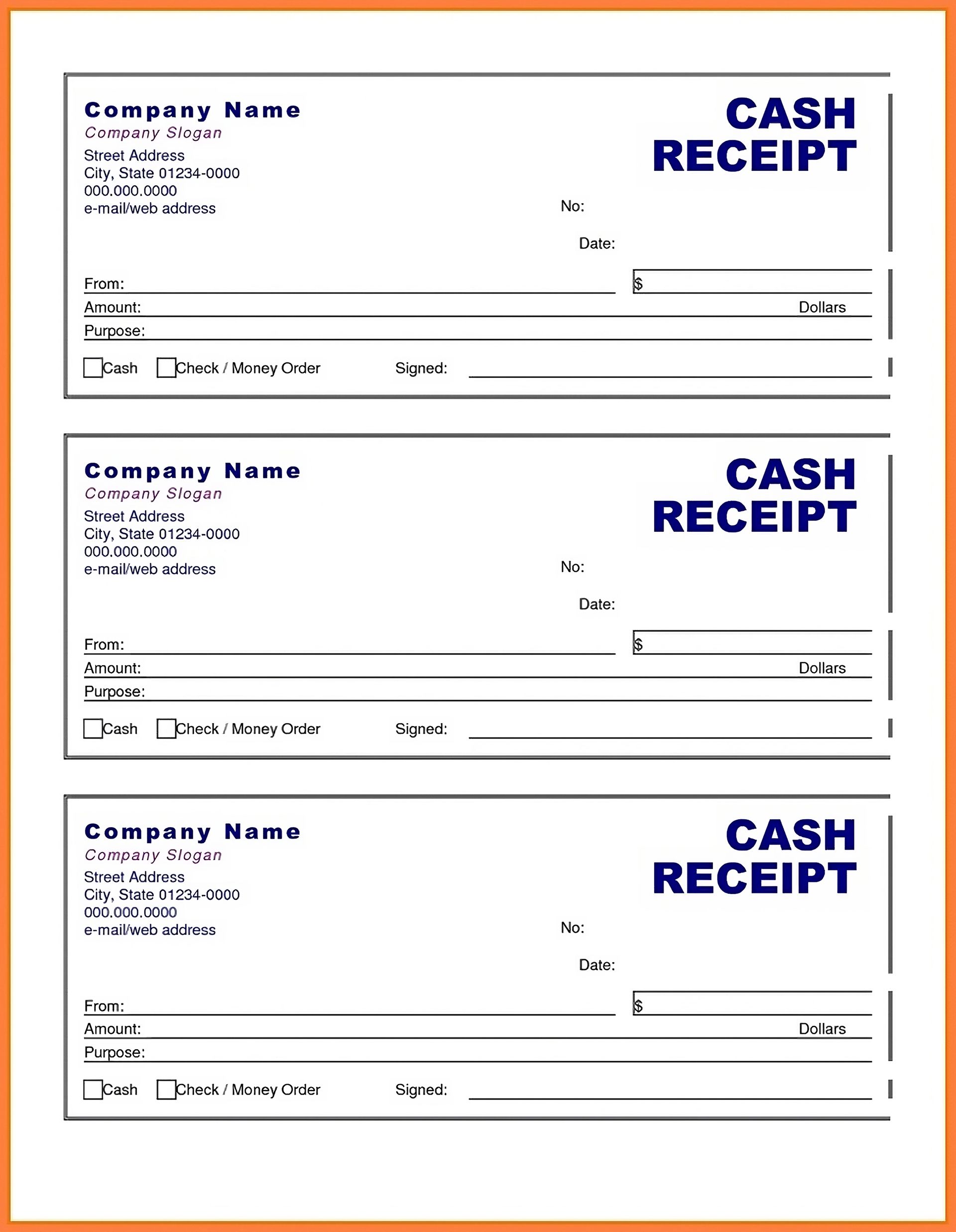

Structure of a cash receipt

A cash receipt should show all the details listed below for clarity and completeness:

- Receipt number: A unique number assigned for tracking purposes.

- Business information: Name and address of the business receiving the money.

- Date of transaction: The date on which the payment was made.

- Description of goods/service: An itemized listing describing what was bought.

- Amount received: The sum total amount in cash received.

- Sales tax applied: If any, the applied sales tax must be stated.

- Subtotal and total amount: A breakdown showing the subtotal before the tax and how much was paid in total.

- Form of payment: Indicates that the payment is in cash, including a check.

- Customer signature: Sometimes, getting a signature may give further evidence.

.

How to create a Cash Receipt?

Below are steps to help you as you design your cash receipt.

- Using a template: Take a template with all the necessary fields, such as receipt number, details about your business, and more.

- Write down transaction information: the date of transaction, items sold, prices, and amount received in total.

- Print multiple copies: For record-keeping purposes, print at least three copies-one for the customer, one for your records, and one to accompany bank deposits, where appropriate.

- Sign: Sign the receipt to validate it, if your business practices dictate

Sample of cash receipt

Here's an example to show how a typical cash receipt might look:

----------------------------------------------------------

CASH RECEIPT

----------------------------------------------------------

Receipt No.: 001234

Date: October 24, 2023

Business Name: ABC Retail Store

Contact Information: 123 Main St., Cityville | (123) 456-7890

Received From:

Customer Name: John Doe

Payment Method: Cash

Description Quantity Price Total

-----------------------------------------------------------

Widget A 2 $10.00 $20.00

Widget B 1 $15.00 $15.00

---------------------------------------------------------

Subtotal - $35.00

Sales Tax - 5% $1.75

---------------------------------------------------------

Total $ 36.75

Thank you for your purchase!

----------------------------------------------------------

Importance of cash receipt to your business

Some of the many important aspects are:

- Accountability in finance: Cash receipts help in tracking the financial accountability of a firm. The records of every cash transaction thus help the companies track their revenues precisely, accounting for all the funds coming into the business.

- Audit Trail: Detailed records of cash receipts are very useful in the form of an audit trail at the time of financial audits or reviews. Through these, auditors can locate sources of income and prove that requirements under the accounting standard are satisfied.

- Dispute Resolution: In cases of disputes on payments or transactions, the cash receipt becomes useful evidence to assist in resolving these disputes between firms and their customers.

- Tax Compliance: For tax compliance, firms should be in a position to know their various sources of income. The cash receipt records will, therefore, assist the management to report the income of the firm for taxation purposes and avail the entity with compliance of all tax laws.

Best Practices of Receipting in Cash Receipt Handling

- Uniform receipt: Whatever transaction a customer pays in cash, there should be a cash receipt issued. This is necessary for the completeness and accuracy of the books.

- Safekeeping: Retain duplicates of all the cash receipts well so as not to misplace them or get them destroyed.

- Periodic reconciliation: Sometimes reconcile your cash receipts with bank deposits to ensure that every dollar of cash is properly accounted for.

- Leveraging technology: Utilize accounting software integrated with the PoS systems that provide automatic receipts, thereby capturing records in the system directly.

FAQs

Q: Why are Cash Receipts Important?

- Proof of transaction: They are regarded as legal proof that a transaction occurred.

- Financial tracking: Cash receipts are used by businesses for tracking cash flow for appropriate recognition in the financial books.

- Tax documentation: Receipts are required for returns and can be used to support or verify expenses against taxation audits.

Q: What Should Be Included in a Cash Receipt?

Generally, a formatted cash receipt involves the following parts:

• Transaction date: The specific date on which the payment was made, indicating when the transaction took place or was processed.

• Transaction amount: The total cash received for the transaction, representing the complete sum paid for the goods or services.

• Description of goods/service: A detailed explanation of the items purchased or the services provided during the transaction, clarifying the nature of the sale.

• Total quantity sold: The total number of items involved in the transaction, reflecting how many units were bought or sold.

Q: How Are Cash Receipts Recorded?

Cash receipts recording takes a few steps:

- Recording: Record the transaction instantly when cash is received to avoid cases of theft or misplaced cash.

- Journal entry: The cash received will be recorded in the journal where there will be a debit entry on a cash account and a credit entry to the sales revenue account

- Daily reconciliation: A business should reconcile the cash register to recorded sales for accuracy at the end of the day

Q: What are necessary internal controls to be instituted?

A business is supposed to institute internal controls that guard against theft and ensure correctness in the processing of cash receipts, including:

• Segregation of duties: One employee should be responsible for receiving cash receipts, while another records the transactions. This separation helps reduce the risk of errors, fraud, and ensures accountability for financial transactions.

• Timely deposits: All cash receipts must be deposited into the company’s bank account as soon as possible, ideally on the same day they are received, to ensure proper cash flow management and reduce the risk of loss or theft.

• Regular audits: Regular checks and audits should be conducted to identify any discrepancies or errors in the financial records. Early detection of issues helps maintain accuracy and integrity in accounting and financial reporting.

Q: Are cash receipts different from invoices?

Yes, cash receipts and invoices serve different purposes. An invoice is a document issued before payment, outlining the amount owed for goods or services provided, while a cash receipt serves as proof of payment once the transaction has been completed, confirming that the customer has paid the specified amount.

Conclusion

The discussion provided within this informative write-up presents cash receipts as one of the sources utilized by organizations belonging to different industries toward ensuring accountability about finances, creating an audit trail, providing evidence to clear disputes, and meeting requirements towards taxation. Most business owners or staff operating financial transactions understand how to appropriately create and manage cash receipts.

Thereafter, we have uploaded various free receipt template for the public. There are 16 different kinds of receipt templates including Acknowledgement Receipt Template, Payment Receipt Template, Fillable Auto Repair Receipt and so forth.