Running a business comes with numerous challenges. One of the particularly tricky areas for a lot of business owners is financial accounting. It can get so confusing that many choose to just delegate this task to a professional or a better-trained member of the staff, which is perfectly fine. But even so, it is critical to have a solid grasp of some key concepts in financial reporting so that you can run your business the best way that you possibly can.

There are quite a lot of aspects to financial accounting and you don't have to go knee-deep into every single one of it. But one very valuable thing is to understand the distinction between a trial balance and a balance sheet. Knowing this is essential for accurate reporting and smart decision-making. Both of these tools are crucial in assessing the financial health of your enterprise. However, they also serve very distinct purposes and are prepared at completely different stages of the accounting process.

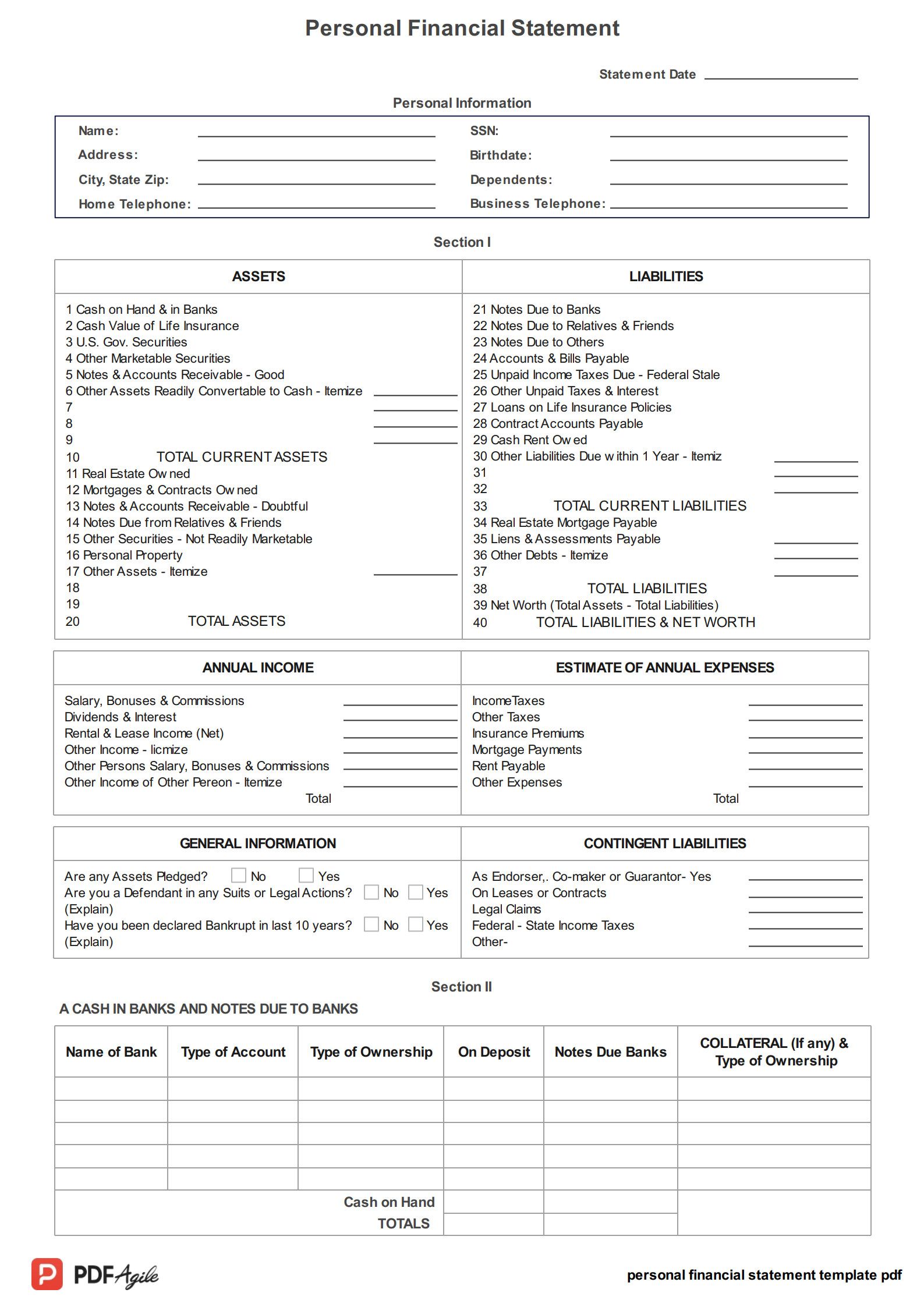

In this article, we will explore the differences between a trial balance and a balance sheet and show you exactly when and why you should use them. We will also answer a question common to many individuals who are new to business or making money – what is a personal financial statement? Not only that, but we will even provide an easy-to-follow guide on how to fill out a personal financial statement effectively.

Understanding Trial Balance and Balance Sheet

The trial balance and the balance sheet are both essential components of financial reporting, but they serve different purposes and present financial data in distinct ways. To better understand the key features of these two documents and why both of them are essential in financial accounting for a business, here's a comparison.

Difference 1: Purpose of Report

- Trial Balance: The primary purpose of this vital bookkeeping tool is to ensure the accuracy of the ledger entries. It lists all general ledger accounts and their debit or credit balances to check if total debits equal total credits. A trial balance is used internally among the management and not shared with external stakeholders.

- Balance Sheet: The balance sheet is an essential financial document in business accounting. Unlike other reports, it serves as a formal snapshot of a company’s financial status at a particular moment. This report outlines key elements such as assets, liabilities, and equity, providing a clear view of the company’s financial health and stability at a specific time. In a nutshell, it summarizes assets, liabilities, and equity to show the company's net worth. This document is used for external reporting and decision-making and is thus made available to investors and stakeholders.

Difference 2: Contents of the Report

- Trial Balance: A trial balance includes the contents of all the ledger accounts of a business. These include the assets, liabilities, equity, revenue, and expenses. Although it is an inclusive report, it does not classify accounts like current and non-current. It shows raw data without adjustments for errors or end-of-period accounting.

- Balance Sheet: The contents of a balance sheet include only three components. The first is the assets, which are the resources owned by the company. This includes cash, inventory, and property. Second, we have liabilities, also known as financial obligations such as loans, accounts payable, and accrued expenses. Finally, there is a section for equity, which is the residual interest earned by the owners after the liabilities are deducted from the assets. The balance sheet does not include data on revenue and expense accounts.

Difference 3: Format of the Report

- Trial Balance: The format of the trial balance is quite simple, consisting of a simple list of accounts divided into two columns. The first is the debits column and the other is the credits column. This simple format makes it easy to check that the debit and credit amounts are balanced.

- Balance Sheet: The format used for a balance sheet is a structured layout that is organized into three sections. As mentioned, these are the assets (current and non-current), liabilities (current and non-current), and equity (including retained earnings and share capital). Three columns are typically used to represent these sections. Some also use a horizontal format, where the assets are on the left side, and the right side is for the liabilities and equity. In any case, the balance sheet follows the fundamental accounting equation, Assets = Liabilities + Equity.

Difference 4: When Is It Prepared?

- Trial Balance: The preparation of a trial balance typically happens at the end of an accounting period. It can be done at any time but mostly, it is prepared as part of the process leading up to financial statement preparation.

- Balance Sheet: The balance sheet is traditionally prepared as part of the financial statements. This usually happens at the end of a fiscal year, quarter, or other reporting period.

Difference 5: Who Gets Access to the Report?

- Trial Balance: As mentioned, trial balances are used by businesses for internal purposes. Accountants and auditors are the main users who create and generate these financial reports.

- Balance Sheet: As a reflection of the company’s financial health, the balance sheet is meant to be shared with external stakeholders, including investors, creditors, and regulatory authorities.

How to Fill out a Personal Financial Statement?

If you have never filled out the financial statement before, it might sound like a complex process but it doesn't have to be. Filling out that financial statement just requires gathering accurate financial data and organizing it in the prescribed format. Here's a step-by-step guide that you can follow.

Step 1: List Your Assets

Begin by categorizing your assets into liquid and non-liquid assets. As mentioned earlier, liquid assets include cash, checking accounts, savings accounts, and investments like stocks, bonds, and mutual funds. Non-liquid assets include real estate properties, vehicles, retirement accounts, jewelry, and other valuable personal possessions you might have.

Step 2: List Your Liabilities

List all pending liabilities, including both short-term as well as long-term obligations. Short-term liabilities refer to debts that must be settled within a year or less, such as credit card balances, personal loans, and other small financial obligations. Long-term liabilities are financial obligations that are payable over several years. This includes mortgages, auto loans, and student loans. When listing these items, make a note of the remaining balances and interest rates.

Step 3: Calculate Your Net Worth

This is just a quick computation once you have listed all your assets and liabilities. All you have to do is subtract your total liabilities from your total assets and voila – you have your net worth. This figure represents your financial position and is a key indicator of financial health. Hence it is important to be thorough and accurate in making your lists so that you can get an accurate net worth.

Step 4: Document Your Income and Expenses

Your income should include work salary, business commissions, dividends, rental income, and all other sources of funds. When listing expenses, start with your monthly obligations such as rent, utilities, and insurance, and then proceed to listing other discretionary spending.

After completing these steps, be sure to review and verify your document. Double-check all entries to ensure accuracy. Errors can lead to incorrect assessments, particularly if the document is for a loan application. Also, be sure to update your financial statement periodically to reflect changes in income, expenses, assets, and liabilities.

Final Thoughts

Understanding the differences between a trial balance and a balance sheet is essential for accurate financial reporting and decision-making. While the trial balance focuses on verifying ledger accuracy, the balance sheet provides a comprehensive view of a company’s financial health.

Additionally, if you're looking for some free and beautiful templates, check out our PDF Agile Template Centers and PDF Agile Statement Templates.