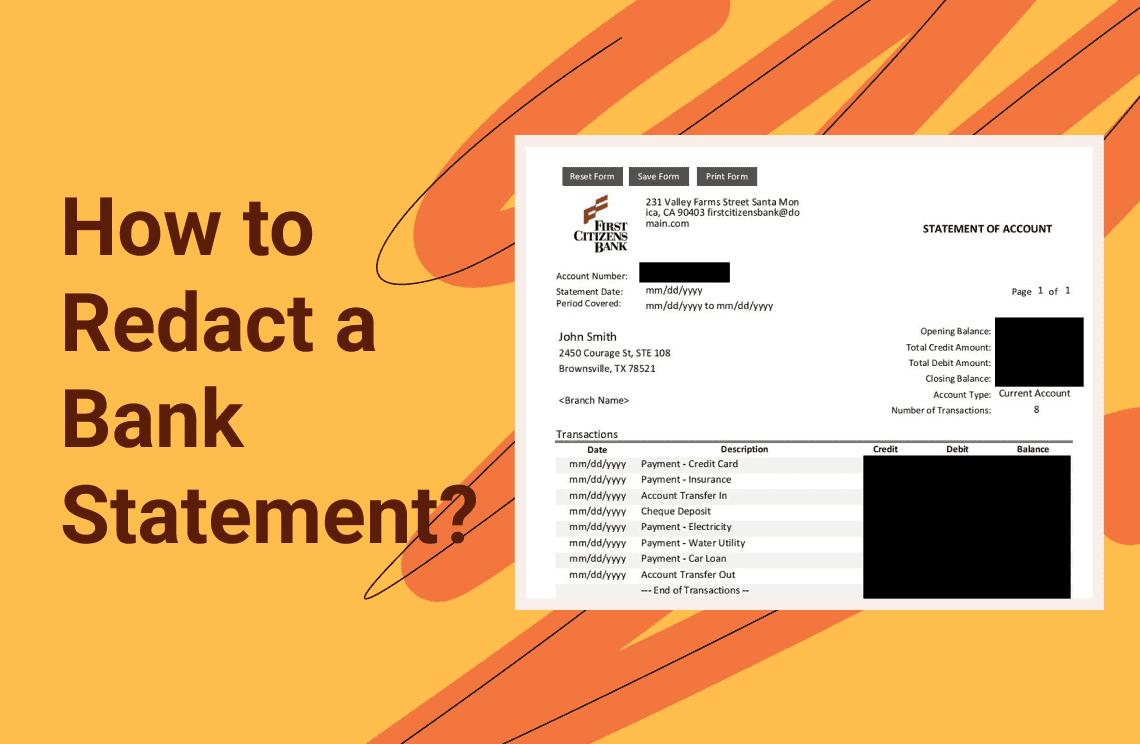

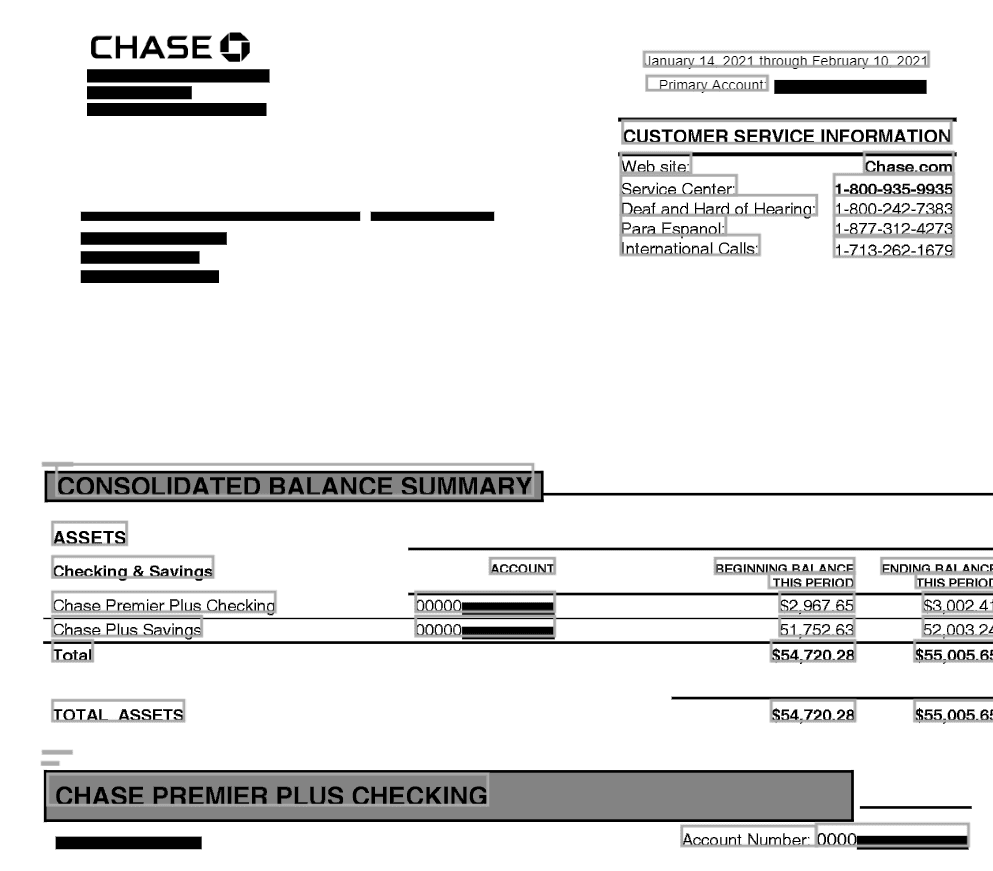

What is a redacted bank statement? A redacted bank statement can be defined as a modified version of an original bank statement where sensitive information, such as account numbers, personal addresses, or specific transactions, is obscured or removed. This process ensures that private data remains secure while still allowing the recipient to verify necessary details like income or account activity. The main goal of redaction is to balance protecting personal information and providing sufficient transparency for the intended purpose. It also protects data security, ensuring sensitive financial data do not get into the wrong hands, and preventing Identity theft. This informative write-up will enlighten you on how to react to a bank statement.

Key Differences between Redacted and Unredacted Bank Statements

In a redacted bank statement, sensitive information is hidden or blacked out to protect privacy. In an unredacted bank statement, on the other hand, the document displays all details without any modifications.

Why do you need a redacted bank statement?

Redacting a bank statement can be necessary in situations where you need to share financial information but want to safeguard your personal data. Other words for redacting are blocking, hiding, and masking.

Redacting can be necessary when you want to take a loan and the lenders require proof of income, but do not need access to all transaction details or full account numbers. It can also be necessary when handling rental agreements. Some landlords request bank statements to confirm financial stability without requiring certain sensitive information like your account number.

In addition, a redacted bank statement can come in handy when dealing with legal proceeding,s and you need to protect your sensitive financial data while still serving as evidence in court cases. Anytime you have to share your financial records with clients or partners, you can also redact irrelevant details to maintain your privacy.

Furthermore, a redacted bank statement can be necessary when dealing with tax filings with third parties especially if, redacting your personal identifiers, like social security numbers is essential for privacy.

What Information Should be Redacted?

The specific details you need to redact depend on the context in question, but some of the common sensitive data to consider include the following:

- Full account numbers (leave only the last four digits visible).

- Social Security Numbers (SSNs).

- Personal addresses and contact details.

- Transaction descriptions that reveal private information.

- Credit card or debit card details.

- Balances (in some cases, depending on the recipient's requirements).

How to Redact a Bank Statement?

There are several methods to redact sensitive information from a bank statement effectively and some of them are described below:

Method 1. Manual Redaction

If you want to redact a physical document, you can use a black marker to obscure sensitive text on the document. You should also make sure the ink completely covers the information so it cannot be read even when held up to light.

While this method works well, it is time-consuming and also prone to errors. It is equally not suitable for digital sharing unless the redacted document is scanned afterward.

Digital redaction using PDF editors

Examples of tools you can use for this are Adobe Acrobat, Foxit PhantomPDF, Preview (on Mac), etc. The tools allow end users to redact text by blacking out specific sections digitally.

Follow the steps below to do this:

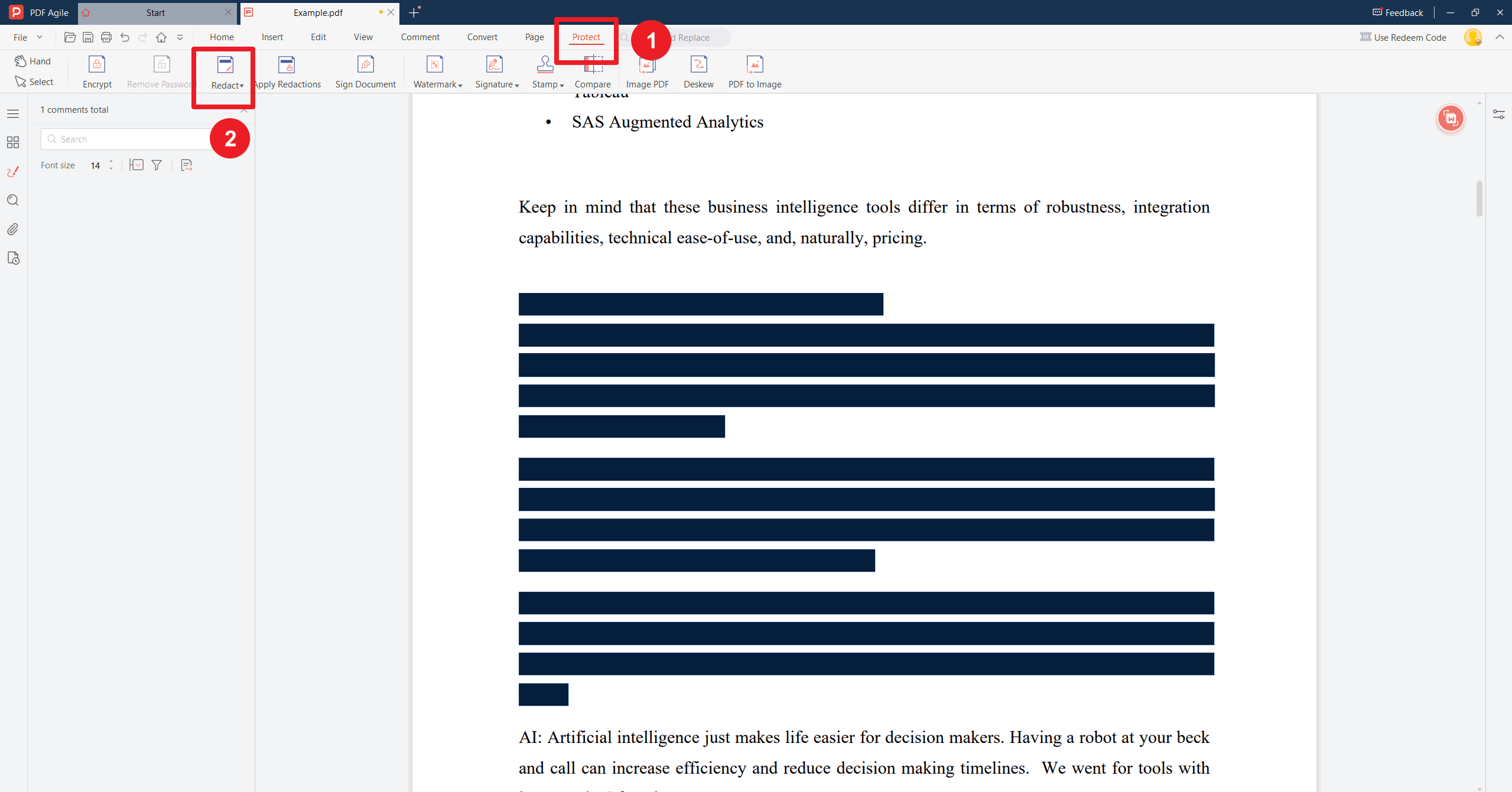

1. Open the PDF file in the PDF Agile. And go to the "Protection".

2. Use the "Redact" tool to mark sensitive areas.

3. Apply and save changes permanently.

The major benefit of using this method is that it is easy to use and also precise for digital documents.

Method 2. Automated Redaction Tools

Software like Redactable and UPDF come with several AI-powered features that help in identifying and masking sensitive data automatically.

Some of its outstanding features are

- End users can share the file directly with others via email or a sharable link following redaction.

- There is 100% data security and the tool can also be used offline.

- Bulk redaction for multiple documents.

- Optical Character Recognition (OCR) for scanned documents.

- Permanent removal of metadata and hidden text layers.

Automated redaction tools are fast, accurate, and can handle large volumes of documents.

Blurring Information in Images

If you want to blur parts of a screenshot or scanned copy of a bank statement, tools like BlurMe can be trusted for this. It can blur sensitive sections in image formats, like PNG and JPEG. While this method is quick for informal sharing, it is less secure than PDF redaction tools.

Important points to consider when redacting bank statements

1. You should retain necessary information if they are non-sensitive; examples of such are your name, partial account numbers, and relevant transactions that prove income or financial standing.

2. It is also important to double-check redactions to verify that all sensitive data is fully obscured and cannot be recovered by unauthorized parties.

3. Do not forget to save an original copy before the redaction. Keeping an unaltered version of your statement can be important for personal records or future needs.

4. In addition, always use only secure tools and opt for reliable software that has permanent redaction capabilities; this can help you prevent accidental exposure of hidden data layers.

Why Redacting Bank Statements is Important?

1. Protection Against Identity Theft

Bank statements can contain your Personally Identifiable Information (PII), such as account numbers and addresses. The information can be exploited by cybercriminals if they get access to it. Submitting a redacted bank statement can prevent such an occurrence.

2. Compliance with Regulations

Financial institutions and individuals are expected to adhere to privacy regulations like the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS). Proper redaction ensures compliance with these laws. Failure to do this can attract serious penalties.

3. A way of Building Trust

Sharing redacted documents can demonstrate your commitment to privacy and security, which will foster trust in professional relationships with clients, landlords, or business partners.

For Further Reading

The information above would have taught you what is redacted and also opened your eyes to the importance of redacted bank statements, as well as how to redact a sensitive document. A redacted bank statement will protect your financial privacy while meeting verification requirements in various scenarios like loan applications, rental agreements, or legal proceedings. Thanks to redaction, you can securely share your financial documents without compromising your private data. You can try any of the redaction methods mentioned above to protect your privacy. Also, you can find more interesting knowledge articles in Knowledge | PDF Agile.