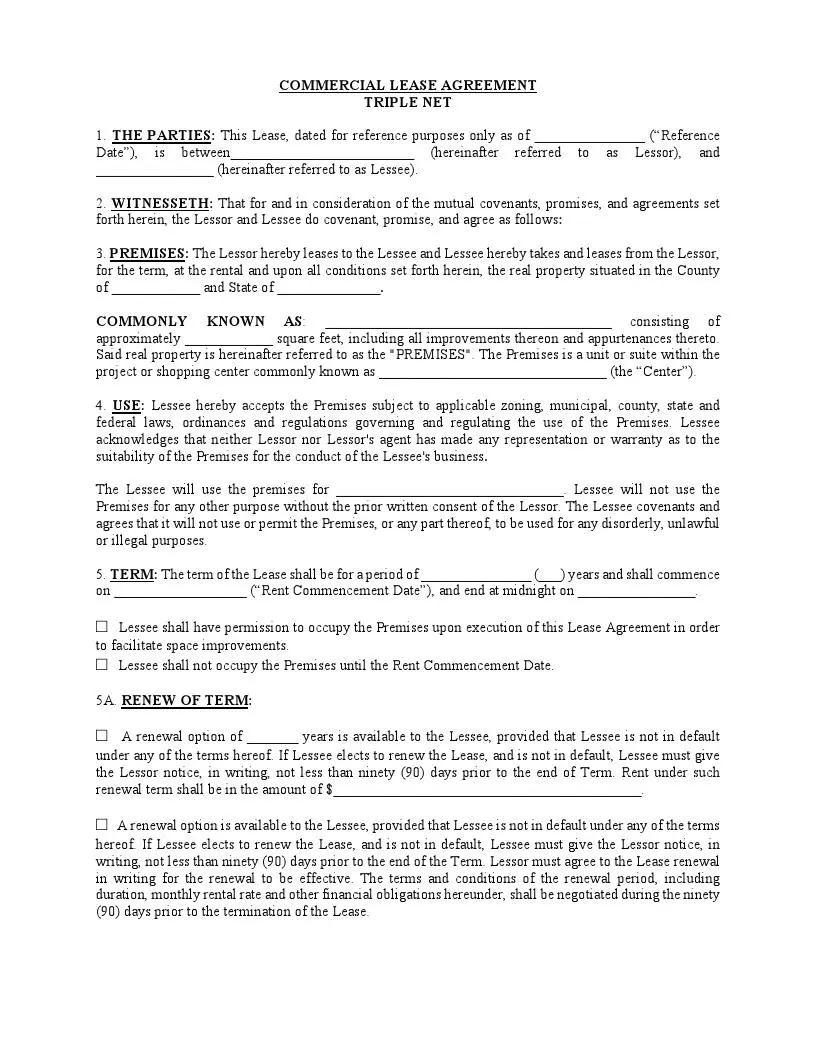

A triple net lease is among the most usual lease deals in which a tenant pays for the rent but also all the operating expenses associated with the ownership, such as property taxes, building insurance, and maintenance costs. One thing you must note about the triple net lease is that it places most of the financial responsibilities of the building on the tenant, giving a far more predictable revenue stream while reducing most management duties from the landlord's perspective at the same time. In this informative write-up, we will enlighten you about the use and benefits of a triple-net lease.

Triple Net Lease Meaning

A triple net lease is a kind of agreement in commercial leasing where the tenant pays base rent and three major property expenses: property taxes, building insurance, and maintenance costs. This structure takes much financial responsibility away from the landlord to the tenant, as it is one of the best options for real estate investors. Additionally, landlords can attain a much more predictable income stream and significantly reduce their management burden by having tenants pay for these additional expenses. Generally speaking, NNN leases are used for single-tenant properties, which include retail stores and office buildings, where there is a single occupying tenant.

The attractiveness of the triple net lease is derived from the fact that in this arrangement, both parties benefit. To landlords, this means less financial risk and less day-to-day management, for which operational expenses are due by the tenant. Such an agreement lets the landlord go about their investment without bogging themselves down with variable costs arising in the operation of the property. On the side of the tenants, although they take up additional responsibilities, many like the base rents lower in comparison to gross leases, where the landlord pays for all the expenses. Moreover, tenants are usually in better control of decisions regarding the management of property, which includes maintenance and renovations that could mean a better space that truly fits their needs.

There are considerations that both landlords and tenants would do before entering into a triple net lease agreement. To begin with, for example, the tenant may have unexpected expenses in maintenance or increased property taxes that would affect overall costs. Also, though the rent in NNN leases is generally lower, the occupancy cost can widely vary depending on how well the property is maintained and in what ways expenses may shift over time. In this regard, landlords need to make sure that tenants are financially sound and able to handle these responsibilities themselves to avoid any problems later on. Overall, triple net leases have a unique balance of risk and reward, potentially beneficial to both parties in the case of proper structuring.

Check Below for Its Summary

- Property Taxes: The tenant is responsible for paying property taxes imposed on the premises. These taxes must be paid on time and in full, ensuring that the landlord is not burdened with financial responsibility. The tenant must comply with local tax laws and regulations during the lease term.

- Insurance: The lease requires the tenant to obtain and maintain insurance at their own expense. This insurance must cover loss or damage to the building, ensuring that the landlord is protected in unforeseen incidents. The tenant must maintain adequate coverage for the duration of the lease.

- Maintenance: The tenant is responsible for maintaining and repairing the facility at their own expense. This includes regular upkeep, necessary repairs, and ensuring the facility remains in good condition. The tenant must promptly address any damage or wear and tear to prevent deterioration and ensure safety throughout the lease period.

The benefit of this, to a landlord, is that they receive a "net" amount of rent with no concern about variable costs that may arise in managing the property. For this reason, NNN can be considered a "turnkey" investment for landlords as they do not have to concern themselves with day-to-day operational expenses.

Uses of Triple Net Leases

The primary usage for triple net leases is for single-tenant properties. These are normally freestanding buildings, often with a single tenant, like fast-food restaurants, banks, or convenience stores. In this case, the tenant is fully responsible for the property, including all costs involved with it. This is beneficial to landlords because they enjoy predictable rents without the complexities of managing properties. The typical case in single-tenant NNN leases pertains to long-term deals, further increasing the predictability of cash flows in landlords. This is beneficial to the tenant as well since they can tailor-make the property to their operation specifications without securing permission from any landlord to improve the premises.

Another frequent use of a triple net lease concerns multi-tenanted property, like shopping centers and office buildings. There, each tenant pays his/her share of property taxes, insurance, and maintenance in proportion to the area of space they occupy. This structure enables property landlords to manage larger-sized properties with efficiency, whereby every tenant will contribute their fair shares regarding common expenses like CAM. The multi-tenant NNN lease can also attract different enterprises, creating a good atmosphere for business, which reflects the interest of both landlord and tenant.

Investors find the triple net lease quite enticing because of their likely outcomes in long-term capital appreciation. Properties under NNN leases tend to have higher occupancy rates because the tenants are motivated to invest in their space and maintain it. In addition, the NNN leases are conducive to the sale of properties since buyers like the aspect of income-producing assets that involve less management involvement. When investors sell their property, they can roll their capital into other NNN investments through 1031 tax-deferred exchanges to enhance their respective investment strategies.

Triple Net Lease Applies to a Range of Commercial Real Estate Settings, Including:

- Most retail shops, fast-food chains, or convenience stores are usually based on NNN leasing. In such a model, tenants bear the operational costs of their properties while landlords get predictable incomes.

- Most office properties are a case of NNN lease, especially when the tenant may want an extended fit-out of the office space.

- Industrial properties would include factories and warehouses, which necessarily are operationally very complex and thus require much maintenance. In either of these instances, triple net lease utilization will be very common.

- The flexibility in NNN leases extends their use into the single-tenant building where one occupies the entire space and the tenant's responsibilities lie directly on themselves.

Benefits of Triple Net Leases

To Landlords

- Reduced management responsibility: Since the operational expenses of the property are normally paid by the tenants, it gives landlords an avenue to earn passively without having to be involved in active management.

- Predictable income stream: This would ensure a much more predictable cash flow for the landlord since tenants will pay most of the variable costs of owning the property, which includes property taxes and maintenance.

- Long-term tenancy: Usually, NNN leases are long-term agreements. As a fact, most range between 10 to a large number of years whereby landlords have assured rental revenue for that extended period.

- Reduced risk: Passing operating costs onto tenants does reduce financial risk for fluctuating property expenses for a landlord.

For Tenants

- Lower base rent: Additional expenses in this setup are borne by the tenant; therefore, the base rent in this case usually remains low compared to a gross lease, where expenses lie on the landlord.

- More say over property management: He is better able to plan for and take care of the building and thus make full use of the facility in the most appropriate way according to his needs.

- Potential for customization: Most of the NNN leases allow the tenants to make improvements or alterations in the property independently without seeking any approval from the landlord, hence building the idea of ownership.

- Incentives to care for the property: Since maintenance is a tenant's responsibility, they will have more interest in the upkeep of the property.

Considerations and Risks

1. Tenant Dependency Risk

One of the major risks associated with a triple net lease is tenant dependency risk. Since tenants take responsibility for most operating expenses, it automatically means that the financial health of the tenant will impinge directly on the landlord's income. If a tenant experiences financial hardship or bankruptcy, they can default on their lease agreements, thus leaving the property owner with costs like payment of property taxes and maintenance until another tenant can be found to occupy it. This gives the landlord extreme financial stress, especially when the periods of vacancy extend beyond his expectations. Besides that, in case there is any sudden vacancy, then the landlords are often left spending a substantial amount to find a substitute for the same, which may further deplete the cash reserves and reduce cash flow on the whole.

2. Limitations with Long-term Leases

Though the triple net leases are generally stable due to long-term agreements, this limits the possible upside from a financial point of view for landlords. Long-term fixed rentals run the risk of being uncompetitive should market conditions vary significantly, and hence, below-market rentals. For instance, the landlord will not be in a position to increase his rent to the prevailing current market rate in the event of an increase in the rate of inflation or improvement in the value of a property during the lease's tenure, except where the lease incorporates escalation clauses. Without these provisions, the landlords will be exposed to the risk of having the returns on their investment fixed at rates lower than they can receive in a better market.

3. Loss of Control over Property Management

Among the other major risks that the landlords run in this triple net lease arrangement is loss of control over property management. The operation and maintenance are provided on a day-to-day basis by the tenants, therefore, a landlord may do little to how the property is maintained. In a similar approach, unless the property has proper care or decisions are made contrary to the betterment of its condition or value, a landlord might say little to do quality control. This lack of oversight will lead to deferred maintenance issues that, over time, will adversely impact the property's value and desirability for future tenancy.

Conclusion

The information above would have enlightened you about the benefits of a triple-net lease to the tenants and the landlords. The net lease or NNN differs from all others in this commercial lease world in describing who pays the property expense between landlord and tenant. The pros possibly entail one or two benefits in accruing at some costs to the tenants for their reduced management responsibilities, although any party entering into this kind of deal should not give any less thought than what this agreement will provide. You should understand the terms and conditions of a triple net lease to ensure it meets the goals of the business and its operational requirements.

In addition, if you have other demands about PDF templates like Agreement or Receipt, please check PDF Agile Template Center.