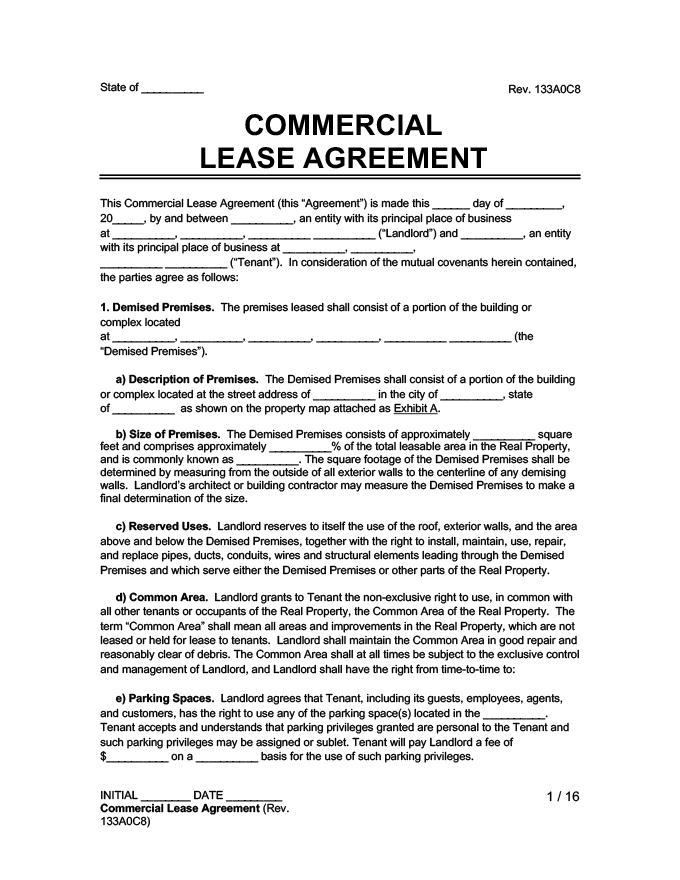

A commercial lease agreement is a legally binding contract between a landlord and a tenant. The property owner is called a Lesser while the tenant is called a Lessor. This document grants the tenant specific rights in the property and outlines the obligations of both parties. Brokers in the real estate industry negotiate agreements for their clients in some cases and this document is an important part of the process.

What Should One Expect with a Lease Agreement?

Typically, a commercial lease agreement will include the following information.

- The names of the parties involved

- A specific description of the property including the structure, size, and address

- The square footage of the space

- Property type

- Social security deposit if any

- How tenants should use the property

- The base rent

- Whether the property will be adjusted or renovated

Types of Commercial Leases

There are different types of commercial leases but here are the most commonly used leases in the real estate industry. We briefly explain them below.

Type 1. Net Lease

A net lease is a very common lease where the tenant is responsible for paying the base rent, including all the utilities, maintenance, and insurance costs. The tenant takes on all the financial responsibilities of the house while the owner only pays the mortgage. Net leases are usually for single-family homes and come in different types. A net lease structure provides landlords predictable income while transferring most property-related costs to the tenant. This arrangement is beneficial for landlords who want minimal involvement in property management while tenants gain greater control over property expenses.

Single Net: This type of commercial lease agreement is by far the simplest to negotiate. The tenant is responsible for the base rent and the tax associated with renting the place. This type of lease is common because it helps landlords meet their property tax commitments. Single net leases are a great starting point for new landlords or investors. They require limited landlord engagement while ensuring that taxes are covered. For tenants, it’s an affordable option compared to other net leases, especially for businesses operating in smaller or suburban properties.

Double Net: This type is used for buildings with multiple tenants. A double lease makes the tenant responsible for the rent, taxes, and insurance. As for the landlord, they are responsible for utilities, insurance, and other maintenance responsibilities. The landlord is also responsible for all structural needs of the house. In general, lease agreements allow the landlord to prorate the taxes and insurance so each tenant will take up a share of the cost based on the square footage they occupy. However, under the double lease system, this is not allowed. Double net leases strike a balance between landlord and tenant responsibilities. Tenants manage major costs, while landlords retain obligations related to shared spaces and structural elements. This is often a popular choice for office complexes or retail plazas.

Triple Lease: Still under the net lease term, we have a triple lease agreement, which is the gold standard in the industry. Under this agreement, the tenant is responsible for most of the costs, including the rent, taxes, utilities, and all maintenance costs. Tenants under this agreement have a much lower rent because of the other costs they have to bear. The landlord bears almost no financial responsibilities for the property. Triple leases are particularly popular for commercial properties, allowing landlords to maintain a hands-off approach. This setup offers tenants significant control over the property, making it ideal for long-term occupancy.

Type 2. Bondable Lease

A bondable lease is similar to a triple net lease but with a far more rigid framework. Under this agreement, the lease cannot be altered or terminated before the expiry date. The tenant bears all the risks associated with the building. Should something happen to the building, the tenant will be responsible for rebuilding it or funding the repairs. However, they must continue to pay the rent as previously agreed. This type of lease is often referred to as an "absolute net lease" due to its strict terms. It’s common in high-value commercial properties where tenants have significant capital and long-term business plans.

Type 3. Gross Lease

A gross lease is not very common but is still in use today. They are of two types.

Full Service Gross Lease: This is where the person taking up the property pays an agreed amount as a fixed rent monthly while the owner covers all other costs, such as maintenance, insurance, utilities, mortgage fee payment, and all forms of taxes. It has an all-inclusive costing where all costs are calculated and the tenant pays a flat fee. This arrangement simplifies budgeting for tenants, making it appealing for businesses in office spaces with predictable expenses.

Modified Gross Lease: A modified gross lease is similar to what we call a full-service lease but with a difference. The tenant will be liable to pay incremental fees if the owner incurs operating costs beyond what was agreed to at the start of the lease. For instance, if property taxes increase, the tenant will pay a portion of that even though their lease hasn’t expired yet. Modified gross leases offer flexibility for landlords, allowing adjustments to operational costs. Tenants still benefit from upfront cost predictability, with added shared responsibility for unforeseen expenses.

Type 4. Percentage Lease

The third type of lease we want to look at is a percentage Lease. As the name implies, this lease is paid as a percentage of the tenant’s income. It is usually adopted for commercial properties like restaurants and other retail outlets. It is calculated as “Base Rent + Gross Profit Percentage “. Both parties agree on a percentage ratio.

How to Create a Commercial Lease Agreement?

If you would like to know how to create a commercial lease agreement, here are the steps to follow.

Identify The Parties Involved: You start by identifying the parties involved such as the tenant, landlord, guarantors, and others. The lease agreement must have their contact information, current addresses, names, and other viable information. The property also has to be described by including information like the size, type, amenities, and current state.

Step 1: Determine The Rent/Term

Your commercial lease agreement should also include the terms, rent, and payment method. You can decide the type of lease you want to go for but it must be communicated in the contract.

Step 2: Negotiate Other Costs

If the building will incur some costs during the lease period this must be clearly shown in the lease. For instance, if the building needs renovation the party responsible for the cost must be clearly stated in the contract. Maintenance costs like landscaping, cleaning, and others drive up costs so they must be included.

Step 3: Taxes & Insurance

You should allocate the taxes and insurance liability to the party responsible for paying them. This will depend on the type of lease structure you have chosen. Taxes to bear in mind include property tax, sales tax, income tax, and business tax. How they will be paid, who should pay them and the necessary adjustments should be considered carefully. Also provide information regarding insurance coverage, requirements, and other features. Who is to pay for insurance and potential damages should be clarified in your contract.

Step 4: Clauses

There must be clauses for contingencies that take care of the rights of the parties involved. This should include potential scenarios that may arise during the course of the lease.

Step 5: Review And Sign

The final step will be to review and correct errors to ensure that the commercial lease agreement covers all scenarios, expectations, and intentions. Once you are sure that all areas have been covered in line with the laws of your city then you can proceed to sign it and offer the same to the other party to sign. It is always best to consult a real estate lawyer before signing a lease to avoid potential pitfalls. Also, do well to keep a copy of the agreement and do any other necessary action that will finalize the process.

Make Your Lease With Ease

You don’t have to be a professional real estate broker or a property lawyer to make a lease that is in line with legal codes. There are lease agreement templates online that you can use. All you have to do is fill in the blank spaces with the right information and you are good to go. You can find the best templates for your lease on the PDF Agile Template Center. The site contains dozens of commercial lease agreement formats so finding one that is the best fit should not be a problem.

Final Thoughts

A commercial lease agreement is a document that lays down the rights and obligations of a lessor and a lessee. It provides ample information about the property, the cost of rent, and other utilities and financial obligations. It also spells out potential penalties for breach of contract. There are different types of leases with different structures. We have net leases, bonding leases, and gross leases and each one has subcategories as highlighted in this article. Now that you know how to create a commercial lease agreement, why not get started now?