You may probably have heard of billing statements but don’t know what it is or what it is used for. A billing statement is a special monthly report used by credit card issuers or companies to show a customer’s transactions and other relevant information about their history. This document is released to the customer at the end of the month through an online medium.

If you would like to know what is a billing statement and how it works, keep reading this article to know more.

How Do Billing Statements Work?

The first thing you should know is that this financial document is subject to state and federal laws so they appear in different formats and show similar but unique details depending on where the issuer is domiciled.

For instance, a credit card issuer has to deliver the statement to the customer at least three weeks before the due date for payment. If the customer pays the minimum monthly payment within the required timeframe the credit card company can not count the transaction as a late payment as this will be illegal.

Furthermore, the billing statement must warn the customer that if they pay only the required minimum amount due they will have to pay more than the overall interest.

Also, more payments will have to be made to cover their account balance. This vital information is shown in tabular form including the potential amount saved both in period and money should they pay more than the minimum amount.

Billing Statements Explained

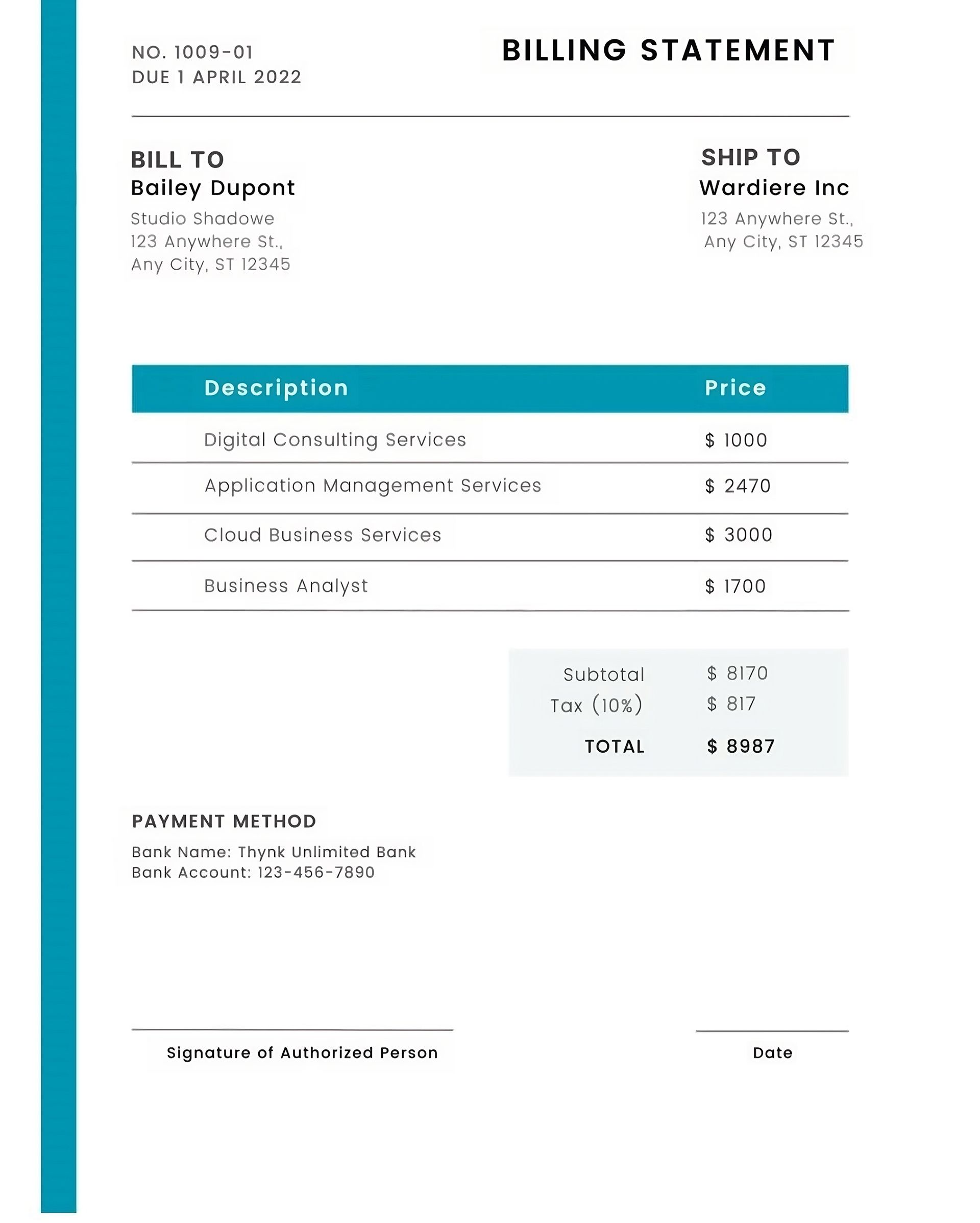

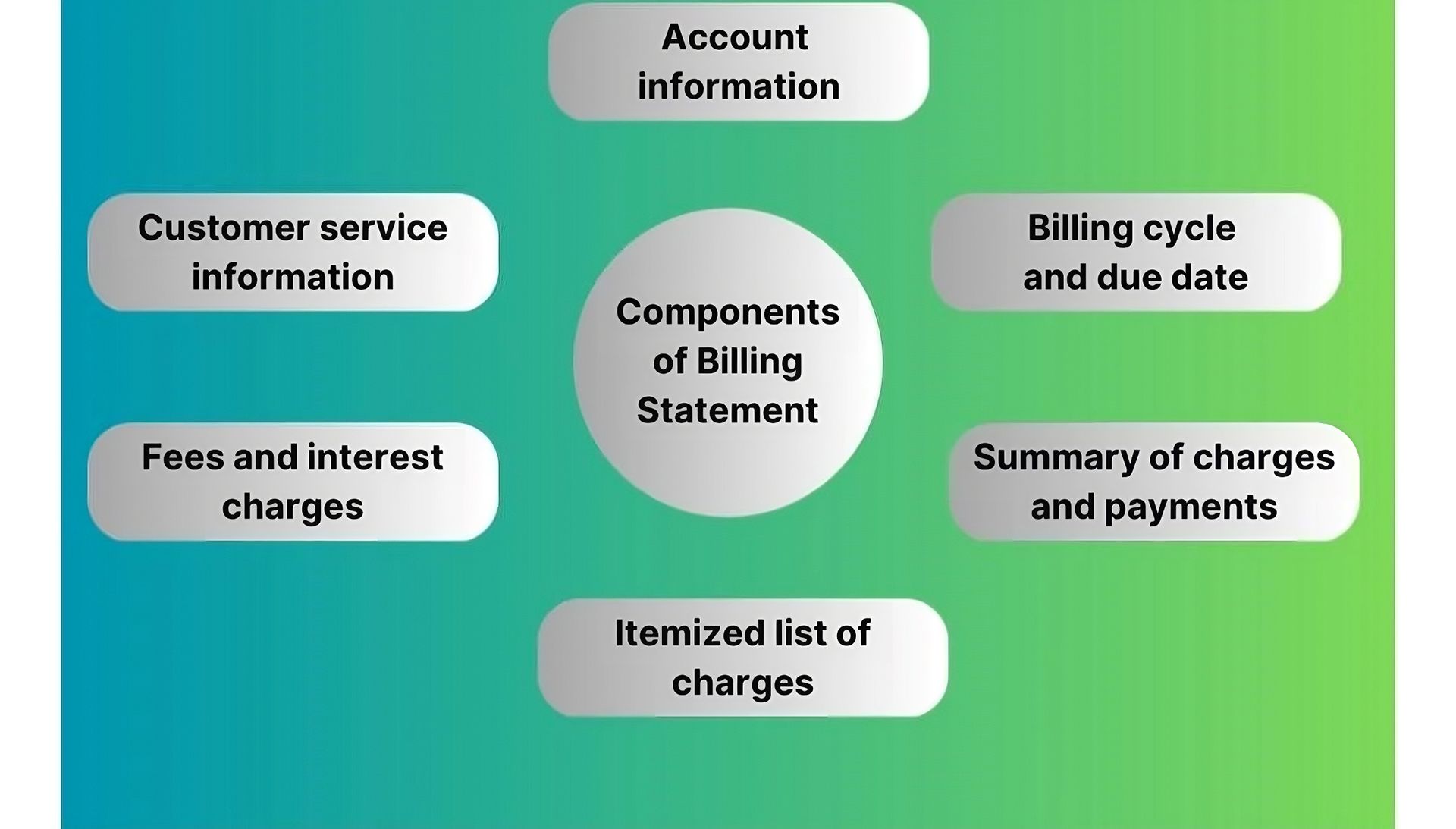

If you own a credit card, you will notice that the structure is fairly standardized and can appear in one or several pages. The categories are usually divided into sections with each one dedicated to a particular information set. Some of the information you will see includes the total balance on the credit card, the deadline for payment, and the minimum payment due for the incoming period.

The deadline for payment will mostly appear at the top of the page.

Another section will give you a detailed account summary and show the previous balance on the credit card, recent payments, and how much money you paid to cover the previous balance. In addition, you will find the total amount of new purchases made during the billing cycle that has just ended, balance transfers, refunds from merchants (if any), interest charged by the credit card company, and the total balance left.

The interest rates differ and can apply to different credit cards such as cash advance or purchase cards for balance transfers. These details serve to provide the cardholder with information about their current financial liabilities for the past and future billing cycles.

Billing statements also provide information about transactions that have occurred since the previous cycle alongside their dates. These activities are shown as listings with the date, address, payee name, and the amount charged to the credit card. They may also include other necessary details. For airline tickets purchased with a credit card, information about the city of departure and arrival may also be shown in the record.

Based on federal and some state laws, billing statements should also include the credit card company’s customer service contact alongside the account holder’s rights as a customer in case of possible errors or potential disputes and how to initiate a chargeback in case of mistakes. Lastly, the billing statement must include airline miles, credit card points accumulated, and the current reward balance.

How Long Should a Credit Card Holder Keep a Billing Statement?

As a credit cardholder, your billing statement will contain tax information so it is advisable to keep your statements for up to 3 years at the least. This is because the Internal Revenue Service will likely question items in your returns unless you have committed fraud on taxes which by law, has no statute of limitations. Common examples of items with relevant tax information include charitable donations, medical expenses, real estate, and other expenses your business might have incurred.

Keeping your billing statements organized can also help with financial planning and budgeting. They provide a clear record of your spending habits, recurring charges, and any fees incurred. Additionally, retaining these statements ensures you have accurate documentation for disputes with your credit card issuer or unexpected discrepancies that may arise in your account.

Guide for Dealing with Chargebacks in Billing Statements

If your billing statement shows chargebacks you should understand how they work. Chargebacks allow you to hold onto payments for services or products that you are not satisfied with. The first action to take will be to complain to the merchant offering the product or service and in some cases, they will resolve the issue. However, should that fail, you will have to ask the credit card company to reverse the payment. To make this possible there are a few requirements you must meet such as purchases that should be up to $50 at the very least.

Furthermore, the service or product must have been made or sent to your home state or not more than 100 miles away from your home address.

The ability to get a refund for poor service or product is one of the advantages of using credit cards in place of debit cards since the latter takes money out of your bank account directly which makes it harder to get a refund.

So anytime you see a chargeback in your billing statement you now know what it means and why it has appeared on the statement.

Conclusion

A billing statement is a document issued by a credit card company to the customer showing detailed information about how much they owe including other important information. It is always advisable to review your statement monthly for errors that could increase your debt or reflect payments you may or may not have made. Additionally, it is a valuable document to keep for tax and budgeting purposes, especially if you use your credit card for regular purchases.