As financial activities increase at a fast pace today, both individuals and businesses seek bank statement analyzers as the best way to automate their financial management processes. Such tools give them immense insight into spending habits, sources of income, and the overall health of their finances. This article explains why you need a bank statement analyzer and goes further to recommend effective options in the market.

Outstanding Facts about Bank Statement Analyzer

A bank statement analyzer is a software tool designed to automate the extraction and analysis of data from bank statements. It normally includes the following features:

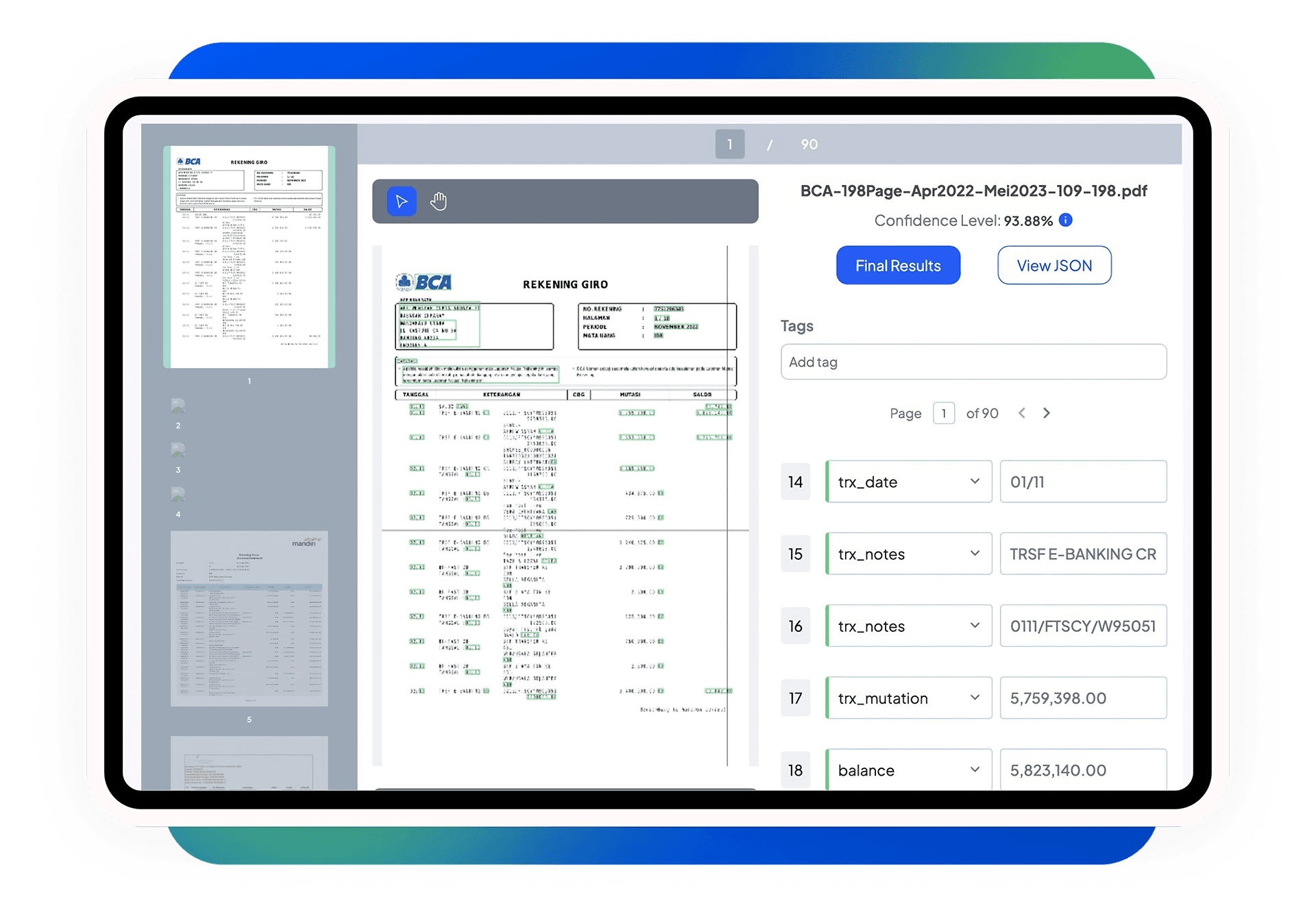

- Automated data extraction: Recognizing and extracting the relevant information from bank statements, such as transaction dates, amounts, and descriptions.

- Transaction categorization: Transactions are categorized into types like income, expenses, and investments for easier analysis.

- Report generation: Structured financial reporting from analyzed data for financial performance insights.

All of the above features make bank statement analyzers an asset to handle personal finance and/or business operations.

Benefits of Using a Bank Statement Analyzer

1. Increased Operational Efficiency

A major benefit of the Bank Statement Analyzer is its ability to enhance operational efficiency. Many processes are automated, eliminating the need for manual data entry, which saves valuable time. This reduces the chances of human error and allows users to process a large volume of statements quickly. The efficiency gain is especially significant for businesses that need to regularly review numerous bank statements, ensuring smooth operations and faster analysis. By streamlining this process, businesses can focus more on other critical tasks, further improving overall productivity.

2. Improved Accuracy

Automation of data extraction reduces human error in transaction recording. Accurate tracking of transactions can enable users to ensure that the financial records are accurate. This is vital for maintaining good cash flow and making wise decisions.

3. In-depth Financial Analysis

Bank statement analyzers provide a deeper understanding of spending habits and sources of income. By carrying out bank statement analysis, users can recognize patterns in their finances that will enable better budgeting and resource allocation. This capability is particularly useful for businesses seeking to optimize their expenditures and maximize profitability.

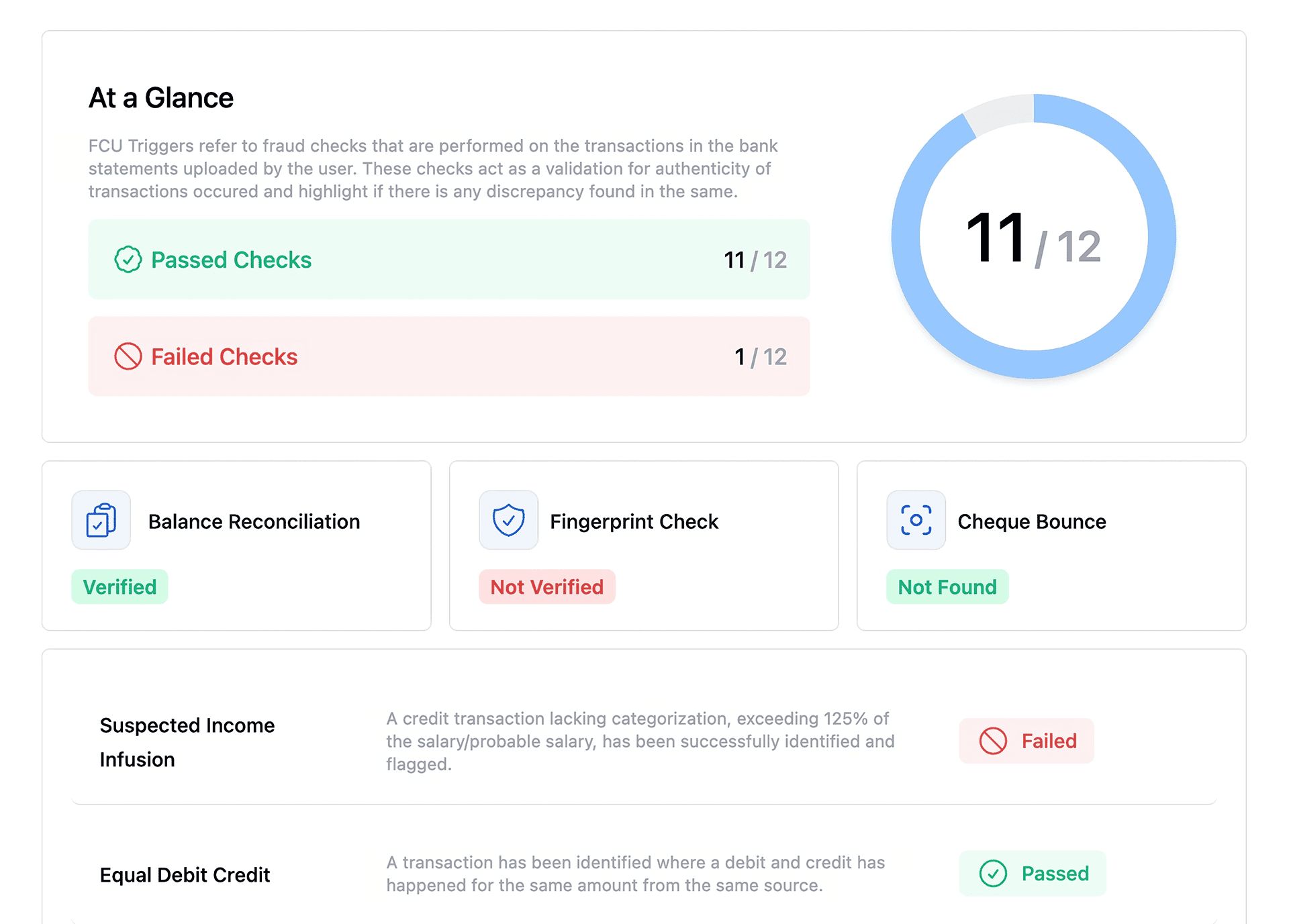

4. Improved Financial Health Monitoring

These tools visualize the financial health of an individual or organization for quick analysis of general performance. Most analyzers can also warn their users about impending risks or suspicious patterns of transactions for proactive measures in securing their finances.

5. Smoothen Decision-making

With comprehensive data at hand, decision-makers can also rely on the insights generated through bank statement analyzers to create strategic choices. The potential to analyze financial trends across time supports long-term planning and enhances overall decision-making processes.

6. Use Cases across Industries

The bank statement analyzers help a wide range of industry sectors in one way or another:

- Retail: Retailers can analyze sales transactions daily, which helps them identify star products and manage inventory more effectively.

- Manufacturing: Manufacturers can monitor production costs and raw material purchases to improve operational efficiency.

- Technology: Tech companies can manage project costs more effectively while carrying out bank statements and analyzing revenue from online services.

- Financial services: Financial institutions can provide clients with clear reports and manage risks by analyzing transaction data comprehensively.

7. Implementation Challenges

While bank statement analyzers offer numerous benefits, implementing these tools may come with challenges:

- Data security concerns: Financial information, which is usually sensitive, demands the best in class in security measures against data breaches.

- Integration with existing systems: Companies may have issues integrating new software with their legacy systems or even the flow of business.

- User training: Staff might need to be trained to work on the new tool and optimize its full potential benefits.

To deal with these issues, organizations must take priority in choosing a reliable software solution with robust security features and ease of use.

Recommendations for Bank Statement Analyzers

Depending on your needs, when selecting a bank statement analyzer, some options to consider are:

1. Fintelite Bank Statement Analyzer

- Features: Automated data extraction, transaction categorization, risk notifications.

- Benefits: It enhances operational efficiency and at the same time provides deep insights into the financial health of the subject.

2. Biz2X Bank Statement Analyzer

- Features: Automatic classification of transactions, and real-time asset verification.

- Benefits: Accelerates loan sanctions due to precise assessments of borrowers' financial positions.

3. Precisa Bank Statement Analyzer

- Features: It provides for elaborate segregation of transactions into inflow and outflow components.

- Benefits: Better assessment capability without losing sight of risks underwriting, while assuring compliance with all applicable regulations.

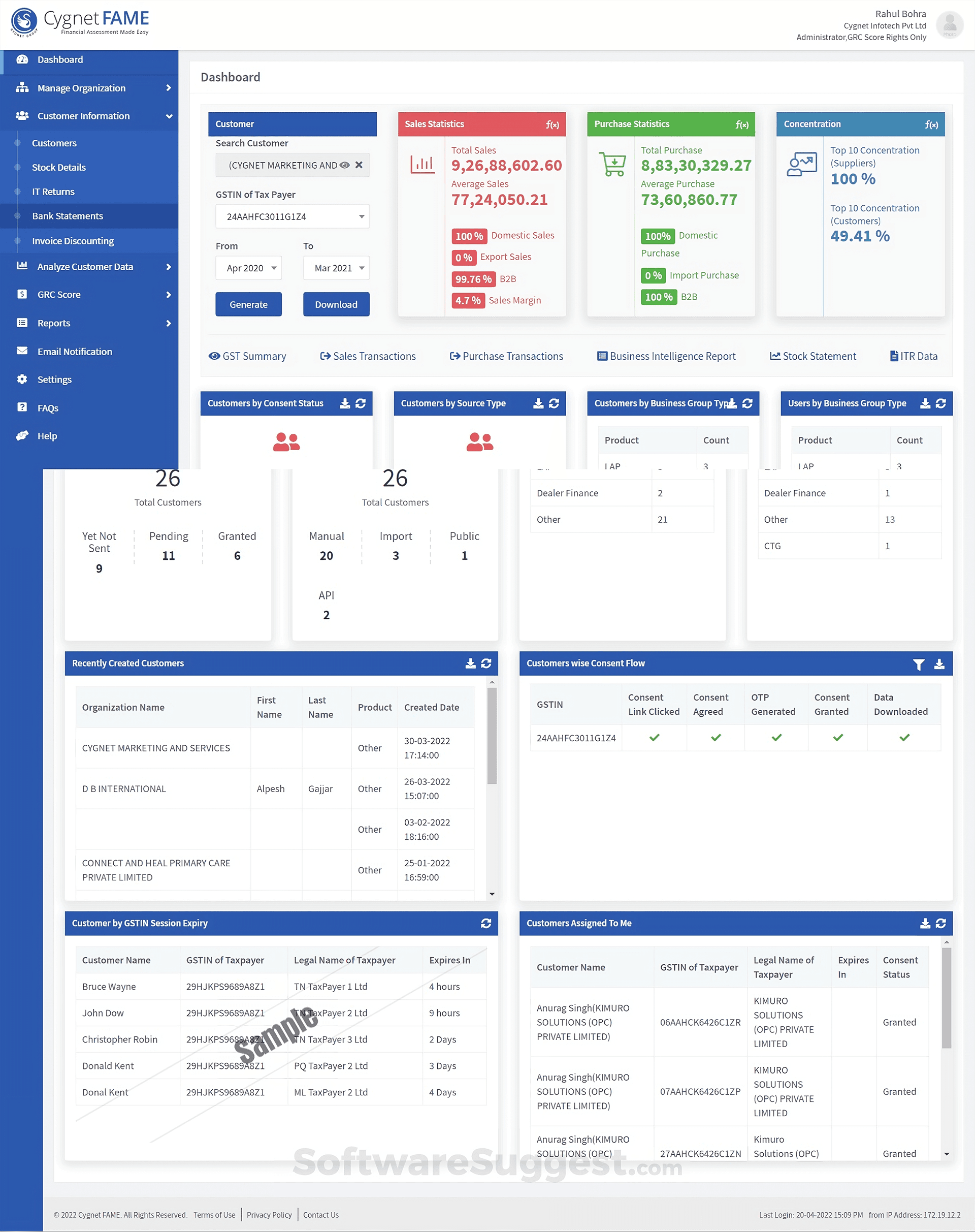

4. Cygnet Bank Statement Analyzer

- Features: Extensive income and expenditure tracking; detection of fraud possible.

- Benefits: Allows users to keep their books of accounts updated and also facilitates the early detection of fraudulent transactions.

5. Quixy Bank Statement Analyzer

- Features: Custom rules for analysis can be provided, and integration with legacy systems is possible.

- Benefits: Flexibility for businesses to customize the tool to specific needs.

FAQs

Q: What is a bank statement analyzer?

A bank statement analyzer is a program that automatically extracts and analyzes the data on your bank statements. It categorizes the transactions, generates reports, and gives insights into financial health. This tool will be very helpful for a business, lender, and any individual who wants to keep his or her finances in order.

Q: Why should I use a bank statement analyzer?

There are several advantages of using a bank statement analyzer. Among these are:

- Increased accuracy: It eliminates human errors in recording transactions. Accurate records must be kept with a clear picture of one's financial health and about regulatory compliance.

- Fraud detection: Several statement analyzers also detect unusual transaction patterns or probable fraudulent cases, adding to overall financial security.

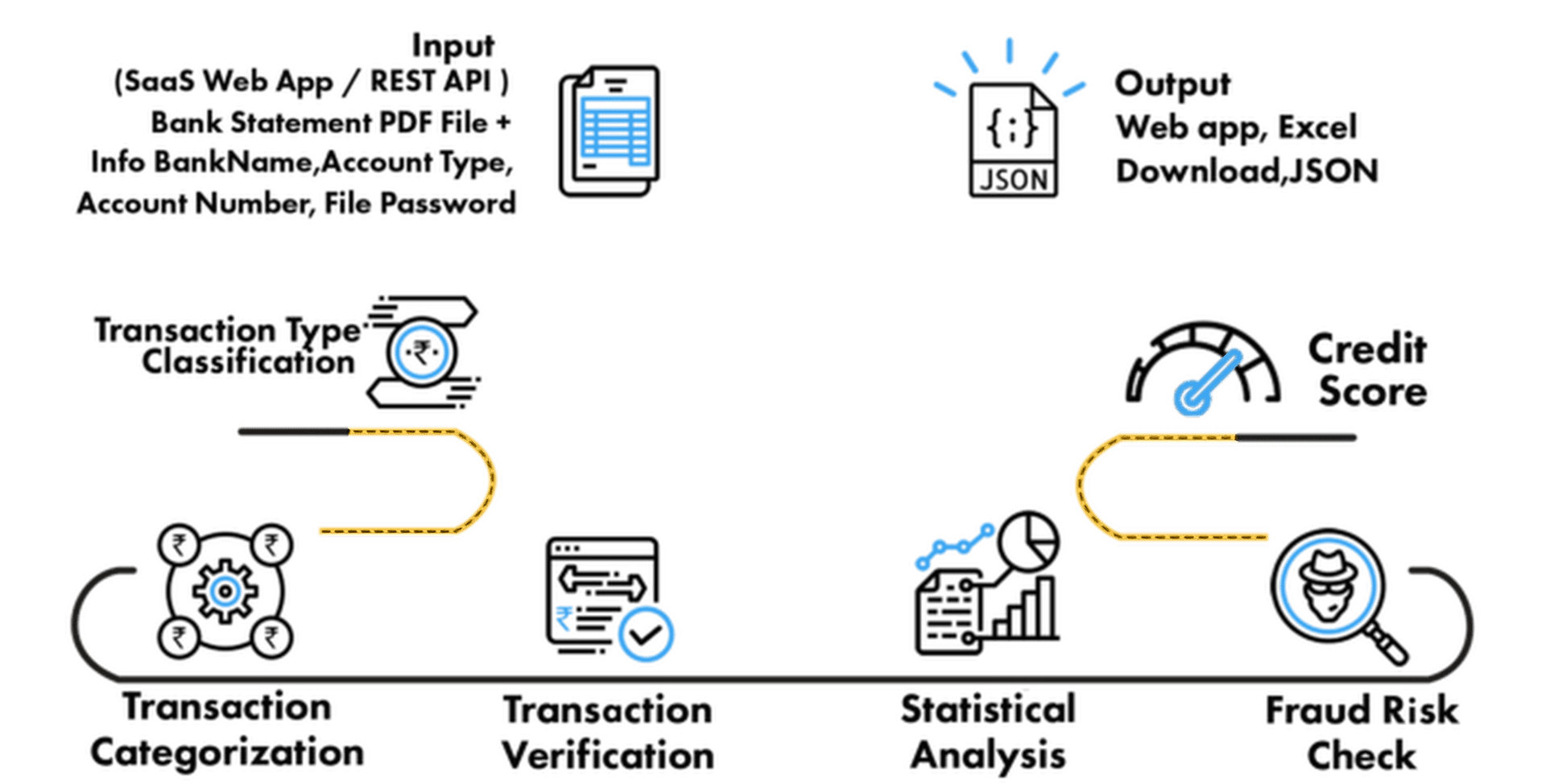

Q: How does a bank statement analyzer work?

Bank statement analyzers normally work in these few steps:

- Data upload: In some tools, users can upload their bank statements, and their formats may vary, ranging from PDF to CSV among other kinds.

- Data extraction: The software extracts relevant information from transaction dates, amounts, and descriptions using OCR technology.

- Transaction categorization: Transactions are categorized into predefined categories such as income or expenses to make the data more analyzable.

Q: Who can benefit from using a bank statement analyzer?

Several beneficiaries may use a bank statement analyzer:

- Individuals: It helps in personal finance management by extracting insights into spending habits and budgeting.

- Small business owners: Small business owners can track cash flow, understand where expenses are going, and prepare for tax season better.

- Lenders: Financial institutions use these for rapid assessment of loan applicants based on the financial health of borrowers through their bank statement analysis.

Conclusion

Money matters are increasingly complex in today's world, but a bank statement analyzer is a vital tool for anyone looking for a way out of the complexity. From increasing efficiency and accuracy in operations to deep analysis of spending habits, these tools create new frontiers for informed decision-making. The most important thing is to get a bank statement analyzer that can solve your specific needs, as it will greatly enhance your financial management. Whether you are looking to ease your budgeting process or make good sense of your spending habits, investing in a bank statement analyzer will no doubt add to your overall financial well-being and success.

![Why Do You Need Bank Statement Analyzer [With Recommendation]](https://cms-cdn.pdfagile.com/Why_Do_You_Need_Bank_Statement_Analyzer_With_Recommendation_2da69b5b11.png)