Banks and financial institutions in recent times have faced the dual challenge of managing vast amounts of sensitive information while ensuring its security and compliance with regulatory standards. They have loads of customers' data and personal information with them, which must be kept intact and safe from the prying eyes of unscrupulous elements. One of the most effective tools they utilize for secure document distribution is the Portable Document Format (PDF). The choice of PDF is mainly because of the incomparable security features it has. In this article, we will explore how banks and financial institutions leverage PDFs for secure document distribution.

Why PDF Is Important within the Banking System?

Check below for reasons banks and financial institutions find PDFs useful for their operations.

Reason 1: Creating And Storing Secure Documents

Banks and other financial institutions generate lots of documents such as bank statements, loan agreements, insurance policies, and compliance reports. PDF is widely used for such documents because it ensures a secure means of creating and storing information and further sharing it.

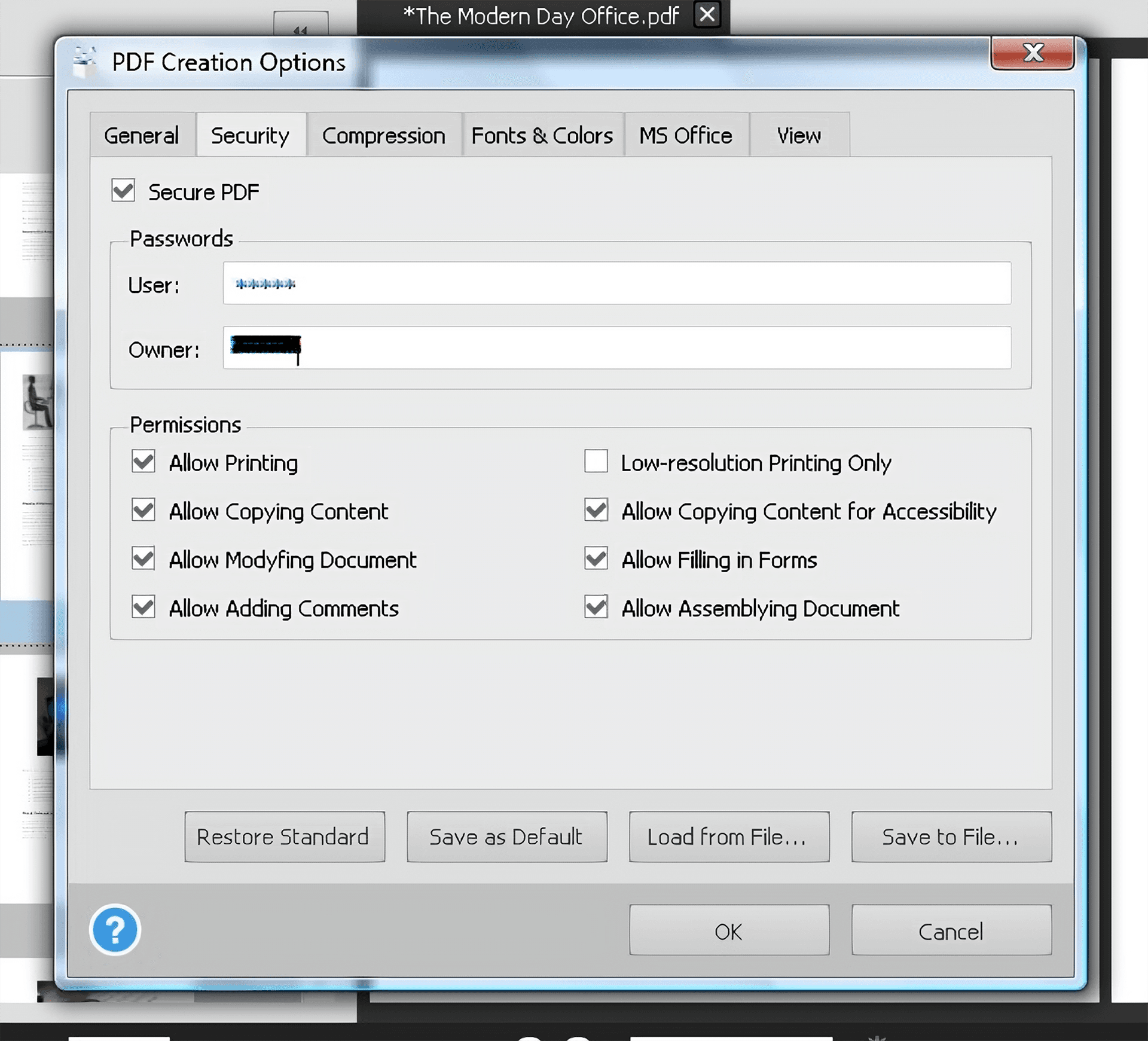

- Encryption: PDFs can be encrypted to protect sensitive data against unauthorized access. In other words, even when a document is intercepted during transmission or accessed by unauthorized users, the content remains unreadable without a correct password or decryption key.

- Digital signatures: This is a security feature employed through digital signatures embedded in PDFs, which many financial institutions use in verifying document authenticity. This feature ensures that additional changes have not been made to a document after it's been signed, thereby ensuring cyber security for financial services.

Reason 2: Streamlined Digital Processes

The use of PDFs can seriously streamline the digital processes of banks aside from ensuring secure document distribution. By converting paper documents into PDF format, financial institutions avoid many inefficiencies that come with paper systems.

- Paperless transaction: At a time when the mantra is digital transformation, banks are increasingly moving to paperless transactions. PDFs help this transition by letting customers receive statements and documents electronically, thereby cutting printing costs and environmental harm.

- Efficient management of documents: PDF software has helped banks manage their documents more effectively. They can create, edit, and arrange documents in a centralized system to quickly provide employees with the information they might need.

Reason 3: Secure Document Sharing

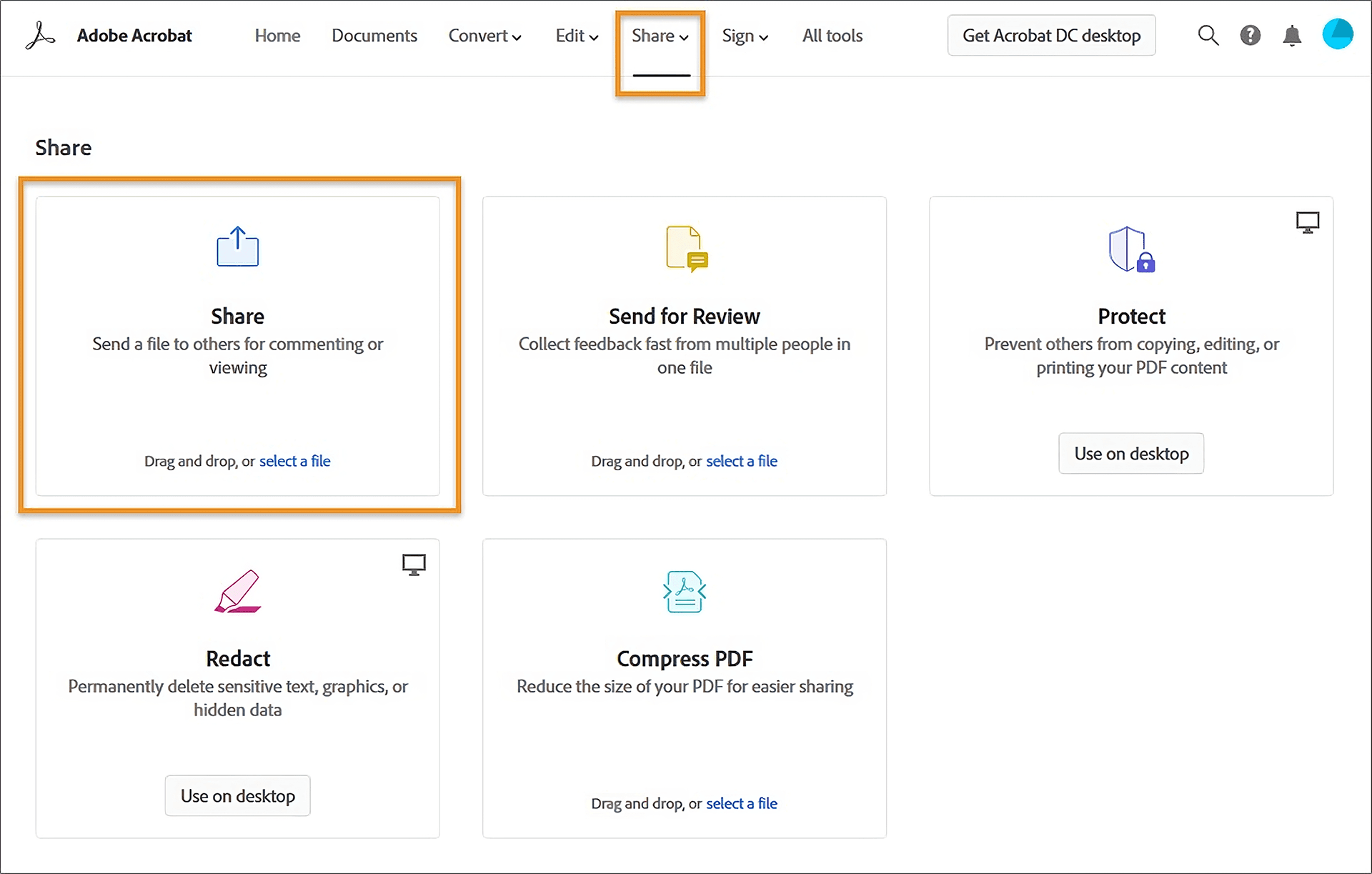

Sharing sensitive documents with clients and other stakeholders requires security. PDFs offer a number of features that enhance secure document sharing:

- Password protection: Banks can even put passwords on PDFs before sending them out to their clients or business associates. This guarantees that only the intended recipients can have access to the documents.

- Secure file transfer protocols: Financial institutions often use secure file transfer protocols, like SFTP, along with PDFs, to ensure that the documents are transferred securely across networks.

Reason 4: Enhanced Customer Experience

Using PDFs also enhances the customer experience through an easily readable format that maintains visual integrity across different devices and platforms.

- Responsive design: PDFs can be designed to be user-friendly on a wide array of devices, such as smartphones and tablets. This adaptability is crucial because a greater number of customers are engaging with their banks through mobile applications.

- Clear presentation: the format allows for clear presentation of complex information such as interest rates, terms of service, and account details without losing formatting or clarity.

Best Practices for Using PDFs in Banking

To maximize the benefits of using PDFs for secure document distribution, banks, and financial institutions should follow these best practices:

- Implement strong security measures: Use encryption for all sensitive PDF documents. Use password protection when sharing files outside of the company. Also, make sure that security measures are up-to-date regarding fresh threats.

- Document security employee training: Start with employee training on security practices for documents containing sensitive information. It should include how to recognize phishing, share sensitive information, and do so securely.

- Trustworthy PDF software: Invest in feature-rich PDF management software that supports digital signatures, audit trails, and security in document sharing. Examples are Adobe Acrobat or any other bespoke banking software, which has features for streamlining processes securely.

- Maintain compliance records: Eliminate paper with a complete record of who has accessed electronic documents and when. Auditing and documentation should include tracking each access to sensitive information.

FAQs

Q: Why Is It that Banks Prefer PDFs when It Comes to Document Distribution?

A: Banks prefer PDFs because they provide them with a secure consistent format in which sensitive financial documents can be shared. PDFs maintain formatting across various devices and platforms, so the documents appear the same. In addition, PDFs can be encrypted and password-protected, which is very key in terms of safeguarding sensitive information.

Q: What Are Some of the Security Features of PDFs that Can Ensure the Safety of Sensitive Documents?

A: PDFs have a host of security features, including:

- Encryption: This prevents unauthorized access to the document.

- Password protection: Users can set passwords for opening a document.

- Digital signatures: These verify the authenticity of a document and that it has not been tampered with after being signed.

- Permissions: Banks may also forbid editing, printing, or copying of the PDF content.

Q: How Banks Encrypt PDFs?

A: Banks use encryption to lock up sensitive information that may be present in PDF format-for instance, bank statements and agreements on loans, among other personal data. Encryption of the same will ensure that only the employees allowed by the bank or any person who has a password can have access to the content, hence avoiding data leakage.

Q: What Is the Place of DRM in PDF Security?

A: Digital Rights Management (DRM) addresses PDF document security issues concerning access and usage. DRM prevents unauthorized copying, editing, or printing of PDF documents. It allows the ability for banks to establish the expiry dates of document access and to establish and enforce policies of usage that may be specific to users or groups.

Conclusion

PDFs play a critical role in the secure document distribution of banks and financial institutions. By leveraging the inherent security features of PDFs, such as encryption, digital signatures, and controlled access, financial organizations can protect sensitive information while streamlining their operations. PDF has proved over the years to be among the best tools for ensuring cyber security for financial services. As the banking sector has started to embrace digital solutions, effective document management with PDFs is something that will be pivotal in compliance matters, enhancing customer experience, and preventing data leakage. You should follow the best practices discussed above while using PDF for secure document distribution to ensure perfection.