In the past, crunching numbers took up the bulk of a company's daily tasks. The accounting department spent excruciating hours organizing budgets and expenses, not to mention the stress of tax season. Fortunately, invoice payment and management software these days solve a bunch of these financial woes.

The best invoice automation services can help you get paid faster, but it can do more than that. Beyond invoicing, these platforms can streamline your processes, resulting in a more efficient workflow. Here’s everything you should know about the best invoice software solutions in this guide.

Explaining Invoice Payment Software

An invoicing program automates how your business bills clients, depending on the nature of the work. For example, your company provides a combination of products and services. The software breaks down the respective costs, displays the total, and sends it as an invoice to the client.

Essentially, the billing software stores relevant business data and pulls them whenever necessary. As a result, you can generate invoices within seconds. So long as you input the parameters correctly, the invoicing process is practically error-free.

More than invoice management, this type of software can handle other tasks, too. It can help monitor your inventory and track contractor hours based on the itemized bill. In some cases, it can streamline the cash flow by granting customers faster and easier ways to pay.

Choosing the Best Invoice Payment Software

There’s no underestimating the benefits your company can reap from using robust invoice automation software. However, it requires investing in the application, especially since this service typically comes with a premium. Nevertheless, it helps save time and ease some of your burdens, translating to potentially better sales in the long run.

When you plan to subscribe to a freelance invoicing provider, these qualities are what you should expect from them.

1. Scalability

It's ideal to select a platform that lets you scale up or down based on the invoicing services you need. For instance, you will need to set some limits on how many clients you bill and how often you do. However, the software should permit changes should you start catering to a bigger clientele. That way, you can avoid switching platforms later to accommodate your needs.

2. Integration with other tools

Isn’t it exhausting to think about keeping separate records for your CRM, sales, and billing? With invoice payment software, you can make the necessary integrations to keep data accurate across various platforms. Now, you don’t have to worry about input errors, which are common when entering data twice or more times.

3. Methods of payment

The best invoice software makes it stress-free for clients to receive their bill payments wherever and at their convenience. Handing over their invoice efficiently keeps them aware of their dues and prompts them to pay on time. Not only can you get paid faster, but they may also pay you more often.

4. Automated reminders

Any customer-centric business should prioritize building and nurturing relationships with clients. It could pose certain problems such as faulty invoice tracking and reminders. With an automated invoicing system, you can send instant reminders to clients with upcoming or late payments.

3 Best Invoice Software Solutions

Jumping right into it, here are the leading invoice automation programs worth investing in for 2024. Refer to the table for an overview of the solutions, with more information further below.

| Best For | Lowest Pricing | Desktop App |

Startups, Freelancers | $15/month | Yes | |

Small- to medium-sized businesses | $30/month | Yes | |

Small businesses, Startups | Free |

|

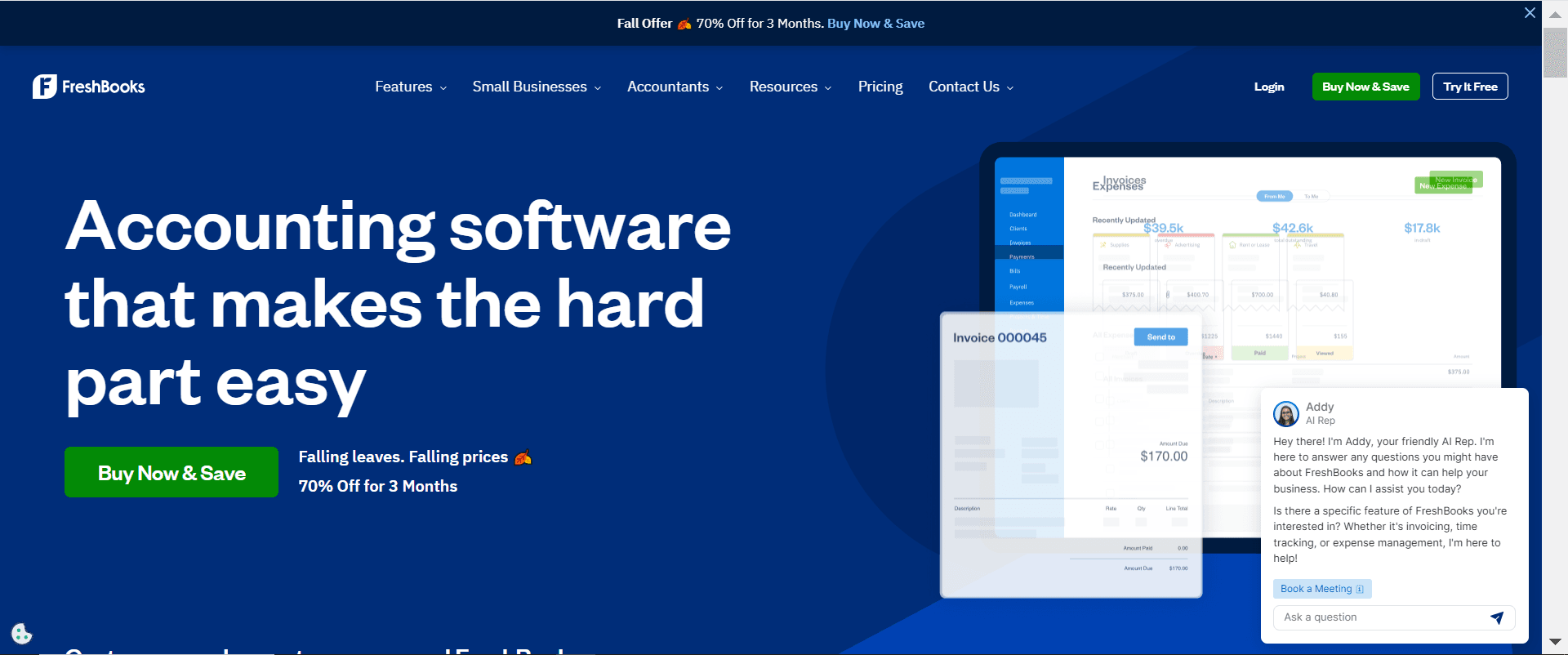

1. FreshBooks

Invoicing platforms that capture the most attention often have intuitive tools and are easy to use. FreshBooks is a great example, but it also boasts a couple more qualities that make it one of the best. Aside from its simple navigation and interface, it allows you to format and edit invoice templates to match your branding.

The site provides tiered subscription plans that fit different types of budgets and preferences. It’s ideal for various business models including small companies and self-employed individuals. This cloud-based platform lets you charge a deposit and send timely reminders for clients, automating menial tasks effectively.

For by-the-hour payments, you can use the timer feature that tracks the total billable time for every project. It fosters smooth collaboration between teams and business-to-client setup, ensuring an exceptional workflow.

Best Features: Unlimited invoices, reports and dashboard, automated reminders

Free Trial: 30 days

Mobile Optimization: Yes

2. Intuit QuickBooks Online

One of the best freelance invoicing and cloud accounting software, QuickBooks lets you create and send billing from any device. There are a ton of features with regular updates and outstanding customer support. It’s a one-stop solution that lets you access and track financial details including expenses, profits, taxes, and more.

There are tools unique to the QuickBooks platform, making it a value-for-money option. It boasts in-person payment and inventory management options that diversify what you can do on the application. It’s one of the most versatile invoice payment solutions available in the market today.

Some of the provider's advanced pricing plans offer next-level benefits such as bank reconciliation and daily monitoring of bank transactions. You can also opt for real-time invoice tracking, enabling you to receive updates via email or text.

Best Features: automated payments and emails, quote deposits, inventory/hour tracking

Free Trial: 30 days

Mobile Optimization: Yes

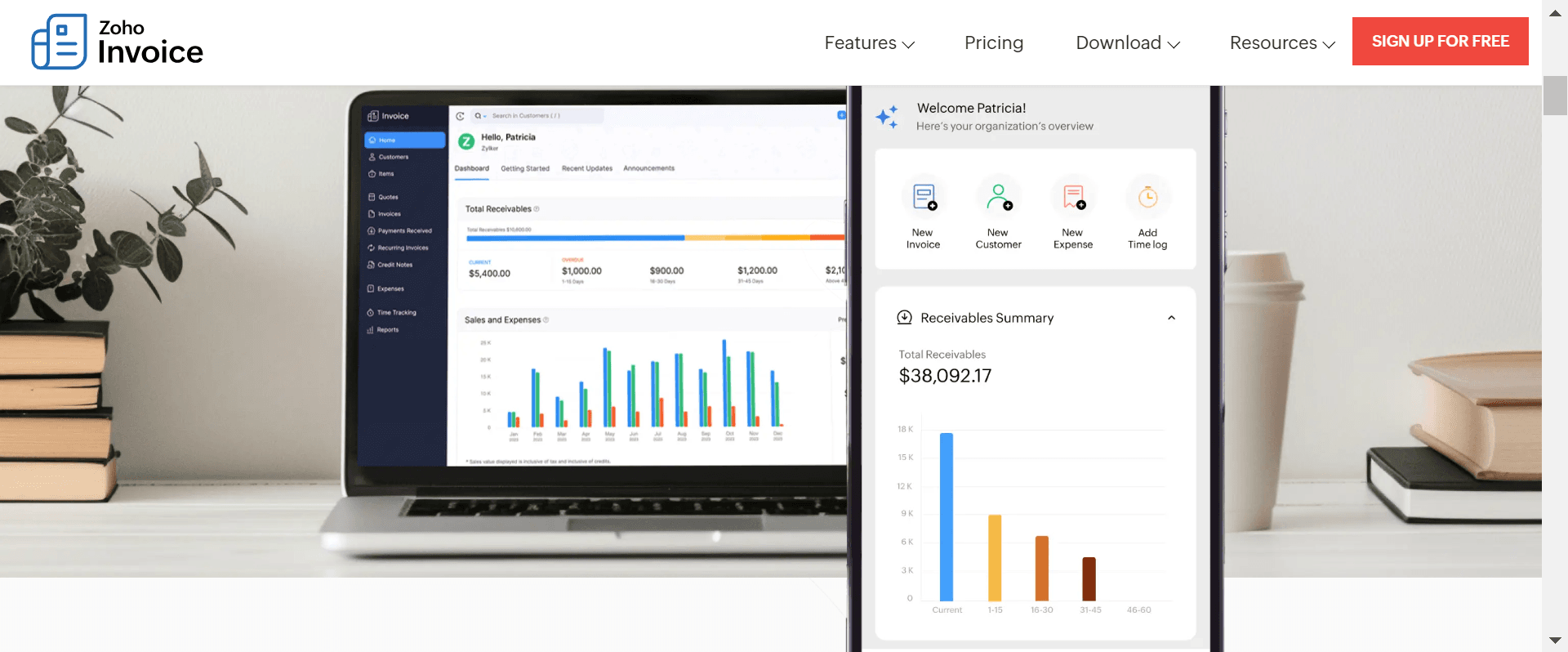

3. Zoho Invoice

Zoho Invoice is an all-in-one freelance invoicing that’s perfect for small business and medium-sized companies. It delivers simple templates, automated reminders, and useful billing tools that you can access for free. You can generate reports and bills across different currencies, allowing you to push your business beyond borders.

Integrating this platform into other Zoho products including Zoho Books and Zoho CRM can make your operations flow smoothly. Doing so can cover not only invoicing but also quotations, expense tracking, as well as synchronizing contacts seamlessly.

If you are a startup on a tight budget, you can avail yourself of Zoho’s free plan. It allows up to five users, letting you test whether it's the right invoicing software for you. You can set up a customer portal to give your clients all access to past payments, upcoming dues, and available credit.

Best Features: free to use, customer portal available, project management tool

Free Trial: 30 days, free plan available

Mobile Optimization: Yes

FAQs

Q: What is the easiest invoice payment software I could use?

A: FreshBooks provides the most user-friendly features and navigation among the top choices. Most beginners can figure out the billing platform and explore the accounting features on their own.

Q: Why should I use billing software?

A: Using invoice automation lets you eliminate most or all human errors during such processes. It also takes over some menial tasks, which helps you save time and boost productivity. Platforms with integration capabilities can streamline your financial systems further.

Q: How do I pick the best invoice management software?

A: You should consider several factors when selecting an invoicing program from the market. Some of the priorities you must set include cost, ease of use, and scalability. You should also choose a provider that grants outstanding customer support should you encounter hiccups while using their platform.