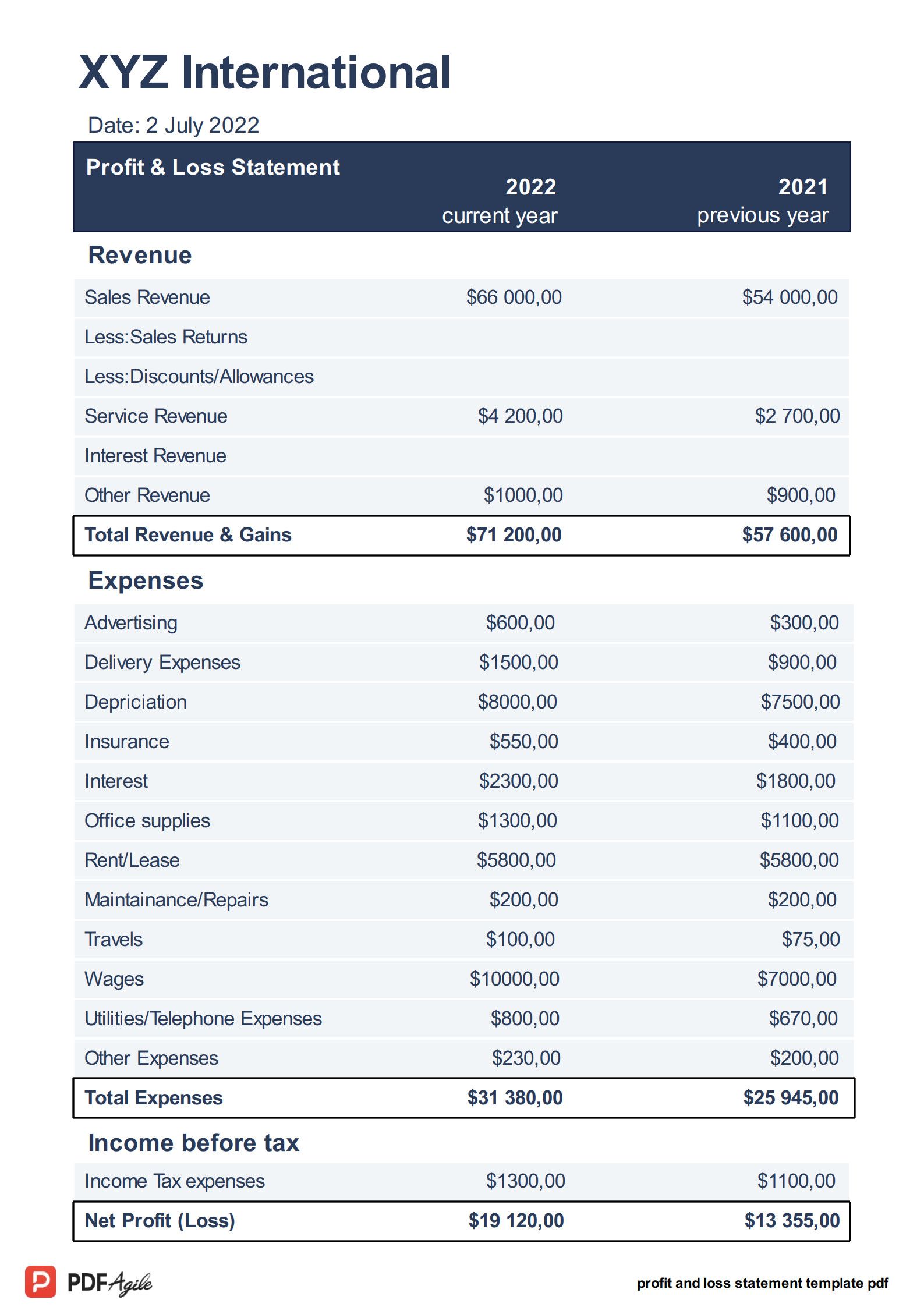

When the exam period is around the corner and you are a student of finance, accountancy, or business studies, it is befitting that you learn to read the P&L statement since it can feature in the exams. The P&L statement summarizes revenues, costs, and expenses of a firm over some period hence giving insight into the financial performance of the business organization. The knowledge can help the organization plan its future toward increasing profitability. In this informative write-up, we will open your understanding of what is a profit and loss statement and also help you make sense of a P&L Statement by decomposing some of the key components involved therein.

Learn the Basic Components of a P&L

The major components will assist you on how to read a profit and loss statement and they are discussed below:

Component 1. Revenue (Sales)

A very simple definition is that revenue is the total income from sales of goods or services before subtracting any expenses. Revenue is often referred to as the "top line" because it's the top single-line entry in a P&L statement.

Example: A company sold 1,000 units for $50 apiece; it would have revenues of $1,000 × 50 = $50,000$.

Component 2. Cost of Goods Sold (COGS)

The cost of goods sold is the cost of direct material and labor costs that are directly attributable to the production of goods sold by a company.

Example: Let's consider an example, assuming that to make a product one requires $20. Now if a firm is selling 1,000 units then the COGS of that firm will be calculated as follows; 1,00020 = $20,000

Component 3. Gross Profit

Gross profit is a value generated by subtracting the cost of goods sold from revenues. It is thus an expression of the productivity of inputs utilized in production.

Formula: Gross Profit = Revenue – COGS

Example: Using our previous figures: $50,000 – 20,000 = $30,000.

Component 4. Operating Expenses

These are expenses of running the business, which are not production costs. They can be separated into the cost of selling or administration salaries and other general expenses.

Example: Assume that the operating expenses for the period are $ 15,000.

Component 5. Operating Income

The Operating Income arises from gross profit deducting the operating expenses. Therefore the operating income, in another light can be referred to as being produced as a result of activities taken in the core business.

Formula: Operating Income = {Gross Profit} - {Operating Expenses}

Component 6. Other Revenues/Expenses and Loss

It consists of non-operating gains, sources of interest income, and non-operating losses sources of interest expenses. Items such as this don't have a direct relation with the normal business operating procedures but tend to add up to the profit on the bottom line.

Example: Interest Income $1,000; Interest Expenses $ 500

Component 7. Net Profit before Tax

It is just a sum of other incomes minus the other expenses within an operating income.

Formula: Net Profit Before Tax = Operating Income + Other Income - Other Expenses

Example: Using our figures: $15,000 + 1,000 - 500 =$15,500$.

Component 8. Income Tax Expense

That is the tax payable from profits before tax. It is subject to varied rates of taxes that may come into play.

Example: If the tax rate is 20%, then the tax expense would be $0.20 × 15,500 = $3,100$.

Net profit (net income): Net profit is obtained by subtracting income tax expense from net profit before tax. It is also for this reason called "the bottom line", as it has the last line in the P&L statement.

Formula: Net Profit = Net Profit Before Tax - Income Tax Expense

Example: Using our example: $15,500 - 3,100 = $ $12,400$.

How to Read a Profit and Loss Statement Fast?

For your exam or to quickly review a P&L statement:

1. The top line is revenue: Look to the top line to get an idea about how much money came in from sales. This figure represents your total income before any expenses are subtracted.

2. Look at the COGS: Subtract this by the number of sales and revenues to appreciate the gross profitability. COGS represents the direct costs of producing goods sold, which impacts your gross margin.

3. Compute for gross profit: Subtract the COGS from revenues; what's left is the money, assuming that production costs are accounted for. Gross profit shows how efficiently you’re producing your product.

4. Obtain the operating expenses: As a proportion of income spent to conduct the business operation minus any form of production. Operating expenses reflect costs related to day-to-day business activities.

5. Search operating income: This will give a proper view of your core operations after considering operating expenses. Operating income shows the profitability of your core business activities.

6. Add other income/expenses: Mention other income or expenses that affect overall profitability but relate to core operations. Other income or expenses include earnings not directly tied to primary business functions.

7. Check net profit before tax: This will give you an idea of overall profitability before the application of taxes. Net profit before tax shows your overall earnings, excluding tax expenses.

8. Final net profit calculation: What is left over after deducting the net profit after taxes is to reinvest or distribute amongst the stakeholders. This is the amount you can either reinvest in the business or pay out to shareholders.

FAQs

Q: How can I tell if a company is profitable or not?

A: If the net income amount is positive, then the venture is profitable; if that amount is negative, then it's an organization running at a loss.

Q: Operating vs. non-operating income-what's the difference?

A: The operating income arises from running activities and the non-operating income is out of the scope of running activities. Examples are interest and investment.

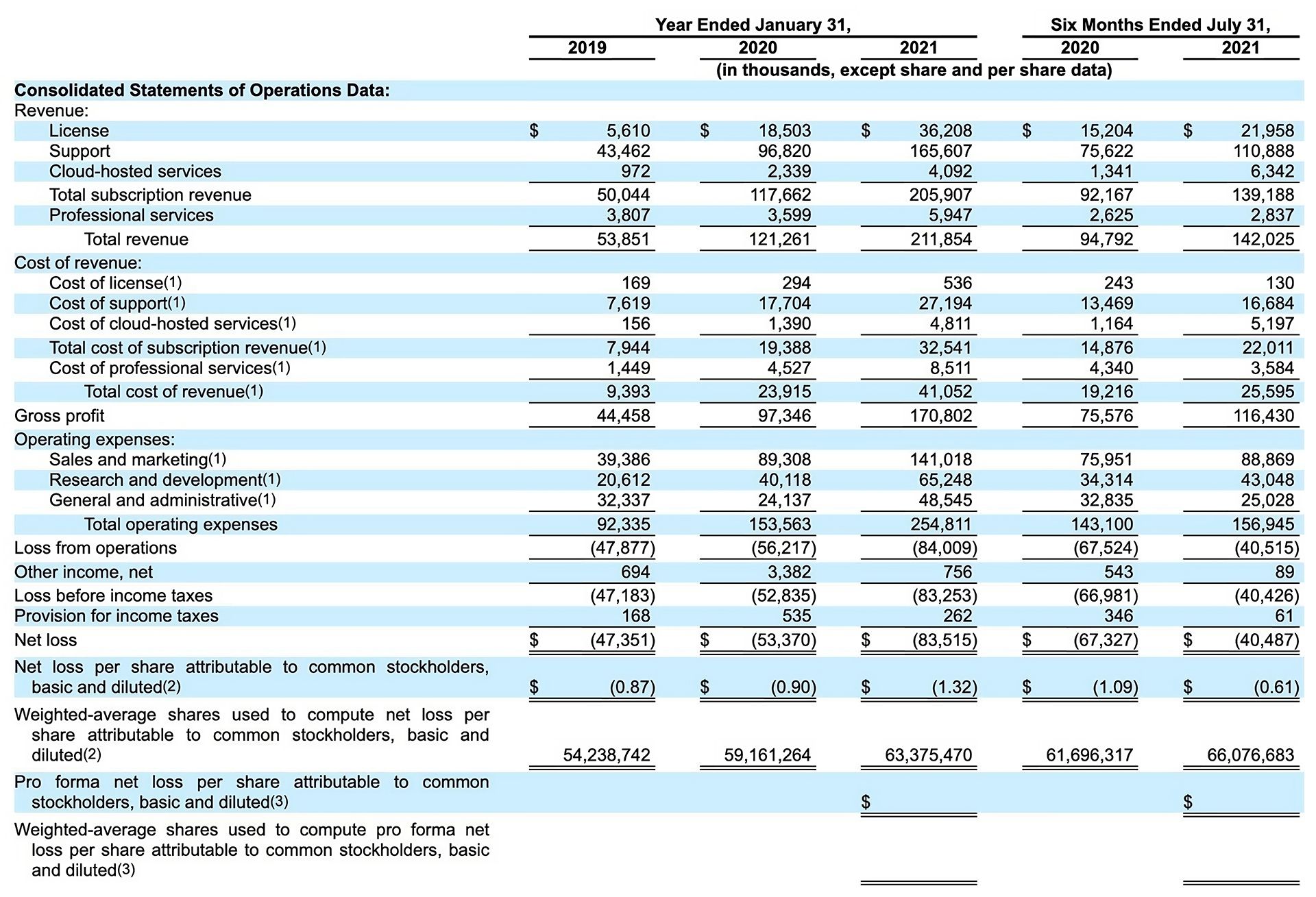

Q: How are comparative profit and loss statements comparable over time?

A: Identify the trend of key measures over several periods. Samples of some of the things to be matched over time to check whether growth or decline is taking place, include revenues, Gross Profit, and Net Income.

Q: Can a company be profitable but have a negative net income?

A: Yes, an organization with extremely high non-operating expenses-those types of things being high interest payments, or high taxes, could theoretically show a net income loss while on an operating basis is profitable technically speaking.

Final Thoughts

There are so many things a student needs to bear in mind regarding the P&I statement when preparing for an exam. The information provided above has opened your eyes to these things and also enlightened you on how to read a profit and loss statement. Every social science student will find the information provided above useful. Following the tips will help you to better understand the associated terms so that you can perform impressively in your exams. We also summarize the subject so that you can grasp the main points in preparation for your exams.

Additionally, if you're looking for some free and beautiful templates, check out our PDF Agile Template Centers and PDF Agile Statement Templates.